BHP profits dive £2.6bn as world’s largest miner falls victim to China’s pandemic restrictions

The world’s largest mining company BHP Group (BHP) has suffered a heavy decline in profits, following a dip in iron ore prices and heavy pandemic restrictions in China last year – its biggest customers.

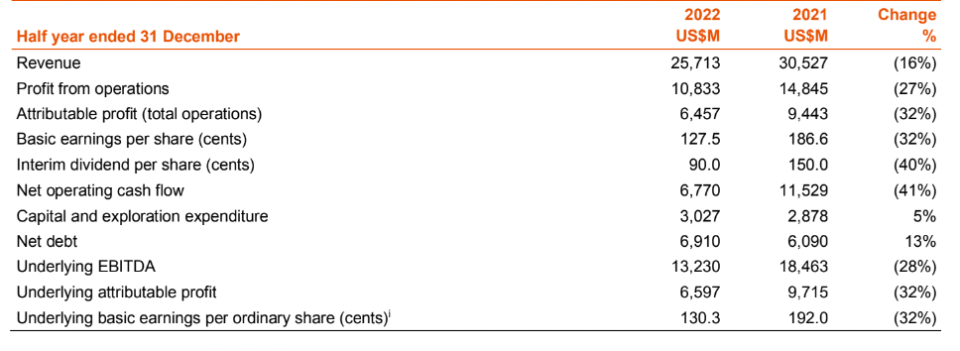

BHP reported a 32 per cent fall in half-year profits – recording underlying earnings of £5.5bn ($6.6bn), down from £8.1bn ($9.7bn) a year earlier – as China’s strict zero-COVID-19 policy curtailed economic activity and dented demand.

This weighed down iron ore prices, while miners grappled with surging costs and a tight labour market in Australia.

Iron ore typically accounts for more than half of BHP’s earnings, but prices were 25 per cent lower year-on-year during the second half of 2022.

Prices have since recovered in line with rebounding demand in China, but the upturn last November was too late to ease the pressure on BHP’s profits last year.

Meanwhile, Aussie firm confirmed that inflation added $1bn to its costs through factors such as higher diesel prices, which were up 70 per cent.

The company also revealed that revenue fell 16 per cent to $25.7bn and pre-tax profit was down 30 per cent to $10.2bn during the six months to December 31 compared with the same period a year before.

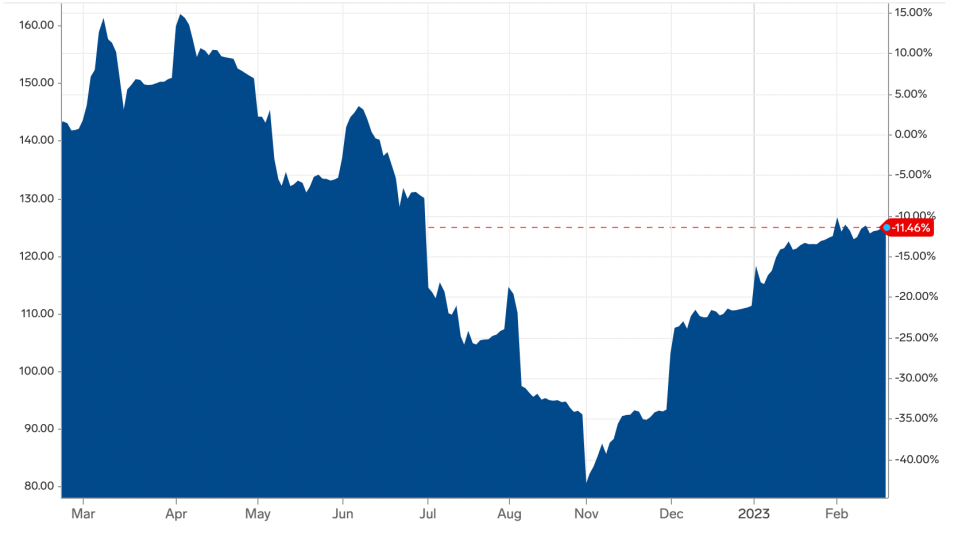

BHP has slashed its dividend 40 per cent from $1.50 per share to 90 cents, as shares in the company fell 2.8 per cent after the headline results, dropping to their lowest levels since early January.

Nevertheless, the hefty $4.6bn payout was the fifth-highest half-yearly dividend in its 138-year history.

BHP bullish over Chinese demand

BHP warned aggressive global interest rate hikes during 2022 would slow growth sharply across developed Western economies.

However, after a difficult first-half, the miner pointed China as a “source of stability” for commodity demand.

The miner’s confidence in China’s economy was strengthened by new loans, resurgent house prices for its burgeoning housing sector, and strong business sentiment surveys.

Chief executive Mike Henry said: “We are positive about the demand outlook in the second half of 2023 and into 2024, with strengthening activity in China on the back of recent policy decisions the major driver.

“We expect domestic demand in China and India to provide stabilising counterweights to the ongoing slowdown in global trade and in the economies of the US, Japan and Europe. The long-term outlook for our commodities remains strong given population growth, rising living standards and the metals intensity of the energy transition, including for steel making raw materials.”

BHP has also brought forward first production at its massive Jansen potash project in Canada to late 2026 from 2027.

It also announced it decided to put up for sale their Daunia and Blackwater coal mines, two of their seven metallurgical coal mines in Queensland’s Bowen Basin.

The decision was made alongside joint venture partner Mitsubishi Development, while BHP has threatened not to invest in Queensland after the state hiked its coal royalties to the highest rate in the world.