Best of the Brokers for 14 September 2015

To appear in Best of the Brokers, email your research to notes@cityam.com

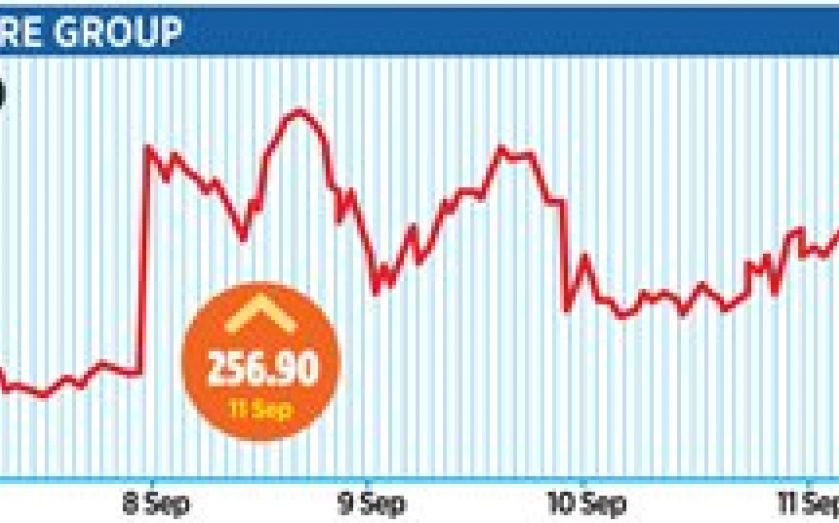

Shore Capital said the year to June 2015 won’t be remembered as vintage. However there were some rays of light in the second half, thanks to the investment manager’s decision to add risk in the face of some severe price dislocations in late 2014 and early 2015. The broker also views Ashmore’s dividend as “safe” given its strong balance sheet. It reiterated “hold” and left its fair value price unchanged at 275p.

Canaccord Genuity has raised its recommendation for BP to “buy” from “hold” and upped its target price to 430p from 415p previously after updating its oil price forecasts to reflect the deterioration in the futures strip. The broker said BP’s leading free cash flow generation forecast over the next few years and a share price that is now at a five year low made it a key attraction compared with its sector peers.

HSBC has initiated coverage of Genus with a “buy” rating and a target price of 1550p, highlighting the expected increase in demand for genetics. The broker said recent investment in its R&D capabilities have consolidated it as a global leader in the provision of animal genetics to the dairy, beef and pork industries. Acquisitions in the bovine and porcine sectors have also strengthened its capabilities.