Bernoulli’s Prisoner’s Dilemma: applying the scenario to modern markets

In 1738, the Swiss mathematician and physicist Daniel Bernoulli proposed a simple thought experiment:

“A rich prisoner who possesses two thousand ducats but needs two thousand ducats more to repurchase his freedom, will place a higher value on a gain of two thousand ducats than does another man with less money than he.”

Let’s place Bernoulli’s prisoner within the context of modern markets and ask him to evaluate various investments. What becomes immediately clear is that his ducats are dedicated to one objective: getting out of prison!

Our prisoner has a goal for his money, just like we do.

Our prisoner can invest his ducats as he sees fit, and because he wants to maximise his chances of release, we can describe his use for various investments with goals-based portfolio theory.

Trading off return and volatility

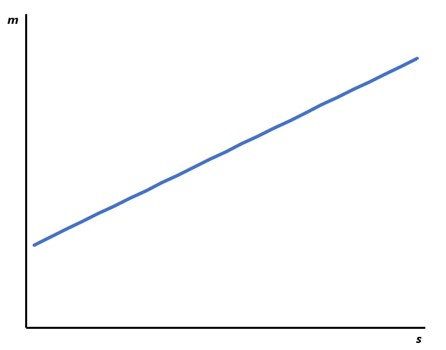

We don’t need to be overly concerned with the details, but clearly, our prisoner will evaluate both the expected returns and expected volatility of a given security over time through the prism of achieving his freedom.

Willingness to trade-off return and volatility is presented in the following graph. The line is the minimum return he requires for any given level of volatility. As volatility or the X-axis, increases, our prisoner requires ever-higher levels of return, as depicted by the Y-axis. This is hardly a revelation: it is exactly what traditional theory would expect.

But what if we build a stock exchange in our prison and let our wealthy prisoners trade shares among themselves? This is where things get interesting.

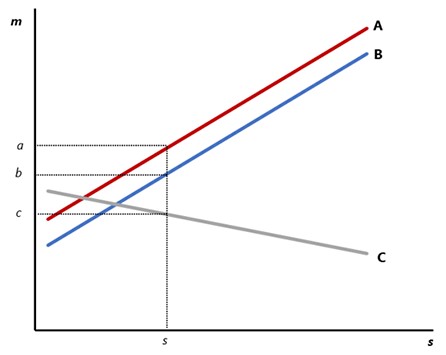

In the second graph, we plot three different prisoners, A, B, and C, each of whom has different starting wealth, required ending wealth and time horizon. For simplicity, we’ll suppose each has the same view of a security’s future volatility and return, which are labelled as ‘s’ and ‘m’.

Here’s the thing: each investor is willing to accept completely different returns for the same security. Moreover, if the security’s price is simply the inverse of return — 1/m, a simple but not unreasonable model — then each investor is willing to pay a completely different price for the exact same security.

There is no difference of opinion about the characteristics of the security driving differing acceptable prices, but rather a difference in investor needs.

When actions confound expectations

When we place these three prisoners in the marketplace, we would expect Prisoner A and Prisoner B to sell their shares to Prisoner C at the price of 1/c until Prisoner C exhausts his liquidity or Prisoner A and Prisoner B exhaust their inventory. Then, the price drops to 1/b, and Prisoner A continues to sell to Prisoner B. From there, the price drops to 1/a, and Prisoner A would buy but no-one would be willing to sell.

Prisoner C is an enigma. Traditional utility models would not expect anyone to accept lower returns in response to higher volatility.

But goals-based investors can be variance-seeking when their initial wealth is low enough. Behavioural finance characterises their goals as ‘aspirational’. This is why people buy lottery tickets and gamble: increasing the volatility of outcomes is the only way of increasing their chance of achieving life-changing wealth.

Lessons about market pricing dynamics

This is more than a simple thought experiment — it reveals some critical lessons about markets.

First, when setting capital market expectations or target prices for stocks, analysts would do well to assess the marketplace of buyers and sellers to determine how their needs and liquidity will influence the coming price. This is more complicated than our example, of course, because in addition to different needs, everyone also has a different outlook for a given security.

This is no surprise to practitioners. Markets dominated by institutional buyers look vastly different than those dominated by aspirational investors and ‘YOLO’ (You Only Live Once) traders.

A very present example is our current regime of quantitative easing (QE) from central banks around the world. For investors befuddled by sky-high stock valuations, the difference between Prisoner A and Prisoner B is illuminating. They are exactly the same except for one thing: Prisoner B is wealthier today.

In general, then, this means that adding cash to financial markets creates investors who are willing to pay more for the exact same security. Conversely, when excess liquidity is drained from markets, prices should drop, all else equal, because investors with less cash today require higher returns. Thus line B moves back to line A.

Second, and most striking: there is no ‘correct’ market price. No security has a ‘fair’ or ‘fundamental’ value. Rather, price emerges from a security’s characteristics interacting with the needs of the investors in the marketplace.

Another key component of price: each investor’s relative liquidity in the marketplace. If enough aspirational investors, or Prisoner Cs, deploy their cash into a security market, prices can remain elevated or spike until their liquidity is exhausted. Sound familiar, GameStop?

What our hypothetical prison stock market demonstrates

This may seem obvious, but it is not the traditional perspective on markets. The efficient market hypothesis asserts that securities always trade at their fair value and that market timing cannot work.

Of course, predicting the development of the fundamentals of a security is a difficult task. But that is only half the equation. As our hypothetical prison stock market shows, understanding the marketplace of investors and their behaviour can yield insights that are just as valuable.

What’s even crazier is that every investor in the market is acting rationally. Prisoner C is offering a perfectly rational price for the security even if it is the highest bid in the marketplace. Prisoner A is acting just as sanely despite having the lowest buy price.

And this is some of the promise goals-based portfolio theory offers. Behavioural finance would describe the price action of our prison market as irrational albeit predictable investor behaviour, and traditional theory would dismiss it as non-existent. But goals-based investors can more clearly see what is really happening.

Goals-based portfolio theory may, in fact, be a helpful bridge between normative and descriptive theories.

Like the prisoner in Bernoulli’s thought experiment, we have specific objectives to achieve with our money. And like the prisoner, we interact with public markets with those objectives in mind.

Those objectives influence prices in ways that traditional theory might not expect. And while behavioural finance offers some models to predict irrationality, goals-based theory suggests that people may be more rational than initially thought.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

By Franklin J. Parker, CFA, founder and chief investment officer of Directional Advisors in Dallas.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Nirut Sangkeaw / EyeEm