Being Paid in Crypto. Will it get you two six-month holidays per year?

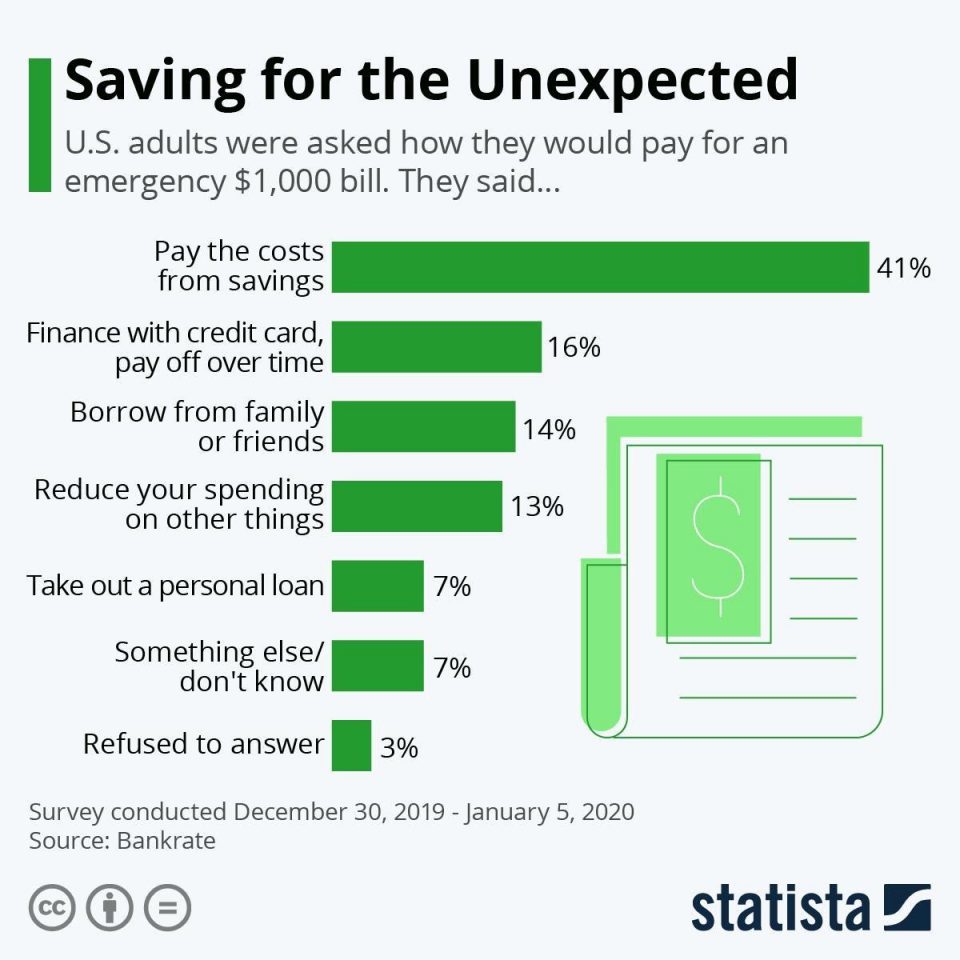

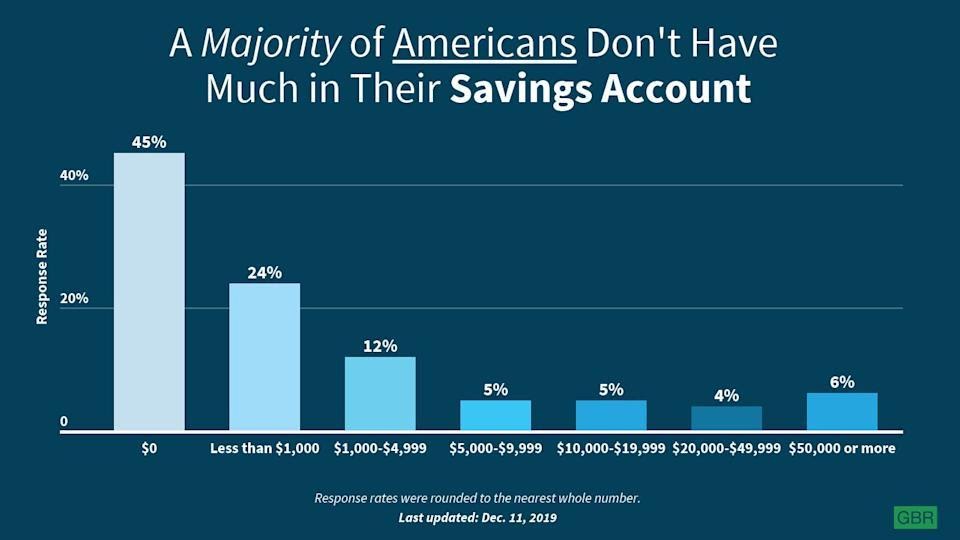

Millions of Americans live in bad economic conditions and don’t have even $1,000 of savings to cover emergency expenses.

In 2019, about 61% of the US population couldn’t cover a $1,000 emergency bill and even stimulus payments haven’t improved the situation. As global economic conditions harden because of the COVID-19 pandemic, Bankrate estimates only 39% of US citizens could afford the same $1,000 emergency expenses in 2021.

As the survey shows, only 20% of Americans had more than $5,000 in savings before the start of the pandemic. This situation isn’t only typical in the US – the UK has the same issue, with nearly one in five (about 10 million people) having less than £100 in savings.

Moreover, growing inflation is decreasing the value of those savings and monetary policy pushes hyperinflation. Normally, the solution would be to invest to save money, but typical investment tools are in danger, too – the stock market is overvalued.

The practical upshot of this is that crypto – and especially cryptocurrencies with low inflation and deflation mechanisms – have become really attractive investment tools.

For example, if you invested $1,000 in Bitcoin in 2013, when its lowest price was about $100, you would now have about 40,000% returns or 400 times your original investment. More recently, later crypto adopters got massive returns on Dogecoin as it rose 12,000% (120 times the starting price) from January to May of 2021.

So crypto, while still being a risky asset, has a potentially very high upside for investing and/or receiving payments and salary. Unsurprisingly, more and more people are willing to take the risk in exchange for a chance at that upside. According to an Ascent survey:

- 14% of Americans already own crypto

- 65% of Americans would use a crypto card with rewards or choose to receive cashback in crypto

- 40% of Americans would like to get part of their salary in crypto

- 49% of Americans would buy crypto if they could store it in their primary (traditional) bank

Clearly, millions of Americans are interested in crypto investment and payments. The US and other nations are ready for mass adoption, but there is a lack of convenient apps and tech infrastructure for newbies and basic users. Building this infrastructure will be a long process because of different legal, tech and UX issues – at least until one company creates a “super app” that combines multiple complex crypto services:

- Purchasing crypto

- Payments in crypto

- Rewards and cashback in crypto

- Solid crypto custodians

Obviously, true mass adoption of crypto is impossible until it becomes an accepted part of everyday life. Since the most popular ways individuals get money are from rewards (promoactions, cashback), state payments, and salaries, mass adoption demands new types of crypto financial services for individuals and companies.

Indeed, implementation of crypto payments is impossible without getting a salary in crypto. And it is entirely possible, even now, to voluntarily convert all payments to individuals into crypto, including pensions – about 40% of millennials would like crypto pensions. People want to get paid in (or convert their salaries into) crypto. Let’s talk about them.

Existing Examples

Some companies already pay their employees in crypto. Early adopters like Finnish software firm SC5 and Japanese web service provider GMO Group have been doing it for a long time: SC5 began in 2013 and GMO Group in 2017.

Argo Blockchain, a cryptocurrency mining company, will become the first publicly traded company to pay CEO Peter Wall’s salary in bitcoins. And large corporations are lining up for the push. Even Twitter is considering making payments to employees and partners in bitcoin, according to Ned Segal, the platform’s chief financial officer.

Another crypto company, the UK’s CoinCorner, has given its employees an option to get all or part of their salary in crypto since 2019. Australian crypto startup Living Room of Satoshi does the same thing.

And it’s not only crypto and tech companies. The Sacramento Kings basketball club offered its players and staff a crypto salary option. Club management thinks that this move will cement the Kings’ status as the most cryptocurrency-friendly professional sports team in the US. The same processes exist in the field of auto racing – crypto broker Voyager Digital sponsored the NASCAR driver Landon Cassill in crypto. Kansas City player Sean Culkin also gets his salary (as of 2021) in crypto.

Regulation

In the US, following FLSA standards, employers may pay salaries in cash, by check, or in another form. However, while it’s possible to pay US salaries in crypto, the regulations applied to those payouts are still unclear. Laws in several states ban salary payouts in currencies other than the US dollar: Georgia, California, Texas, Delaware, Pennsylvania, Washington, Illinois, Michigan, New Jersey, Delaware, and Maryland all forbid non-dollar salaries.

Even in countries that are more loyal to the digital industry, it is not always easy to make payments in cryptocurrency. The growing popularity of crypto has already caused some extraordinary cases where the employer tries to get back monies paid out, since the crypto value grew by 700%.

Right now, the American continent is probably the most crypto-friendly. Miami is close to integrating Bitcoin as a means of payment. In February, the Miami City Commission voted to support the initiative of City Mayor Francis Suarez and allow salaries, taxes, and fees to be paid in bitcoins. The Major also announced his plans to expand the use of Bitcoin in Miami to include the possibility of paying city employees’ salaries in the first cryptocurrency.

Since El Salvador accepted Bitcoin as legal tender, the country now allows salaries to be paid in Bitcoin, according to local Minister of Labor, Rolando Castro.

In Argentina, Congressman Jose Luis Ramon introduced a bill allowing employees and those who export services abroad to receive payment in cryptocurrency. If it passes legislation, it will allow workers to choose between full or partial pay in cryptocurrency or Argentine pesos.

In Switzerland, people who receive cryptocurrencies as salaries must declare them and pay taxes, just like with fiat salaries. The cryptocurrency income of investors and traders is not considered income taxable on capital gains. However, depending on which canton you reside in, there is a wealth tax to be paid on the total of your digital coins.

In the European Union, labor legislation is stricter. For example, in Estonia and Lithuania, the full salary cannot be given in digital coins. Only part of the funds – above the established minimum living wage – can be paid in an alternative form, but premiums of any size can be given in cryptocurrencies. This is a complicated thing: many companies already pay salaries in crypto in the form of bonuses, but don’t tell anyone about it because of regulation issues.

These difficulties are simply running ahead of legislation: over time, more and more countries will create clear regulations for crypto payments and taxation, which means that soon the legislative base for growth for crypto payments will be ready for widespread adoption.

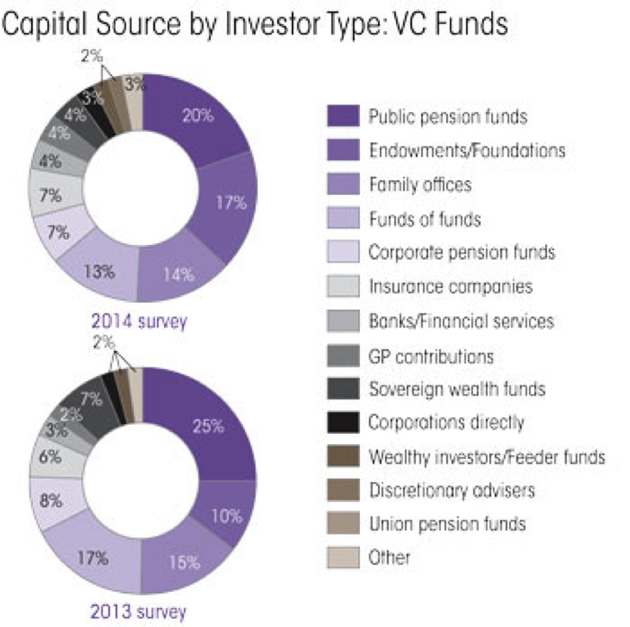

The graph above illustrates that the wave of VC-backed innovative companies (e.g. FAANG) in the early 21st century provided a great upside potential for VC funds’ LP partners, including public and private pension funds.

It is quite likely that crypto will unlock a similar upside option for the common employee, rather than big institutions, and starting around 2021-2022 we will see a sharp increase in demand for this type of service, including salary payments and/or converting part of savings into cryptocurrencies.

Alex Lightman is the founder and chairman of Keemoji and founder and CEO of Keemoji, makers of digital privacy keyboards and a new platform for cashback, payments (in both FIAT digital currencies), managing tokens and digital collectibles. He is the author of Brave New Unwired World and Reconciliation, the co-author of Augmented: Life In The Smart Lane, and recipient of four global awards, including the first Economist magazine Readers’ Award for innovation, beating Elon Musk in a global vote. Crypto AM readers can meet him at the Unlocking Party on July 28.