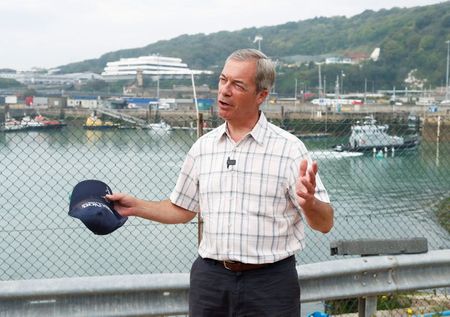

BBC: Nigel Farage Coutts bank account story has been ‘clarified and amended’

The BBC has amended a story about Nigel Farage’s Coutts bank account after coming under fire from the politician for suggesting he lacked the funds needed to hold an account.

The former Ukip leader said he was lodging a formal complaint over the reporting.

The BBC’s business editor, Simon Jack, wrote in a Tweet that the headline in his original story had been “clarified” and an update posted.

He said: “It should have been clearer at the top that the reason for Mr Farage’s account being closed was commercial – was what a source told the BBC. That has been corrected.”

Earlier this month, the BBC reported that Mr Farage fell below the financial threshold required to hold an account at wealthy private bank Coutts.

The bank requires its customers to borrow or invest at least £1 million, or hold £3 million in savings, according to an eligibility questionnaire on its website.

It was therefore a “commercial” decision to shut his account, the broadcaster was told, rather than because the bank disagreed with Mr Farage’s political views.

But Mr Farage later used a subject access request (SAR) to access Coutts documents detailing the reasoning behind his account closure, which he says showed his views “do not align with our values”.

On Thursday, the BBC published an update to the original story saying the headline had been changed “to make clear that the details about the closure of Nigel Farage’s bank account came from a source”.

It also referenced the document showing that Mr Farage’s political views had been one of the key reasons why his bank account was closed.

But Mr Farage responded with a Tweet saying he was lodging a formal complaint, adding: “I want an apology.”

Dame Alison Rose said: “No individual should have to read such comments and I apologise to Mr Farage for this.”

Meanwhile, the Treasury said it was tightening the rules for UK banks over closing customers’ accounts, under changes designed to protect freedom of expression.

It means banks will have to explain why they are shutting someone’s account down. They have not previously had to provide a rationale for doing so.

The move is intended to make it easier for customers to lodge a complaint with the Financial Ombudsman Service if they feel their account has been closed unfairly, according to the Treasury.

The notice period for a forced account closure has also been extended from 30 days to 90 days.

Press Association – Anna Wise