Barratt Developments to beat forecasts with 45pc rise in profits

The figures

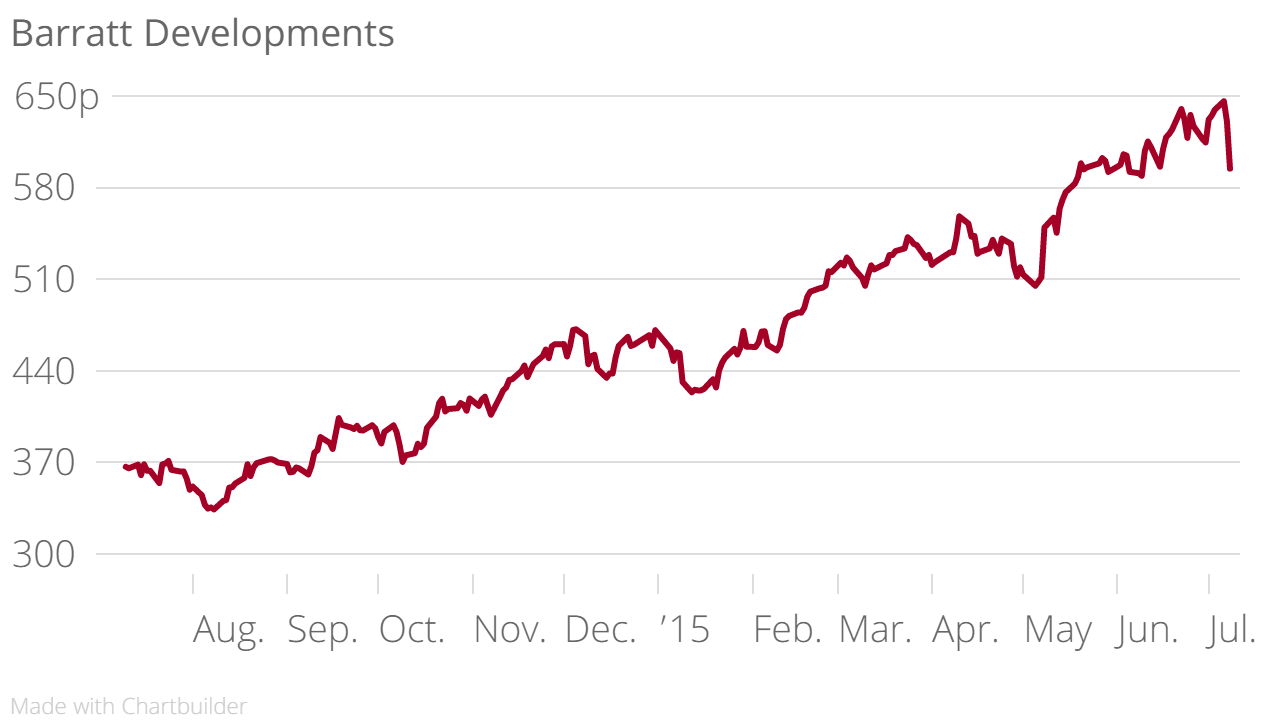

Housebuilder Barratt Developments is expecting a 45 per cent increase in profits for the year to the end of June, it said in a trading update today. The company is set to beat analysts’ forecasts, with a full-year pre-tax profit up to around £565m, while total forward sales are expected to have risen 29.6 per cent to £1.7bn.

Total completions were up 10.8 per cent, to 16,447, while average selling price rose seven per cent to £235,000. However, weekly net private reservations per site fell 7.2 per cent to 0.64.

The full-year results will be released 9 September.

Why it's interesting

The housebuilder’s report makes cheerful reading for its shareholders, who are presumably breathing a sigh of relief after the decidedly housebuilder-friendly outcome of the General Election. The spectre of the Mansion Tax is now just an unpleasant memory for housebuilders: although Barratt's core market remains at the lower end of the market, it still has fingers in London's luxury apartment pie.

Nevertheless – although the UK’s house price growth slowed in the beginning of 2015, total completions surging by over 10 per cent suggests the UK housing market remains strong. Figures out from Halifax yesterday showed an uplift in house price growth for the first time since April. That's good going for a market which had experienced a reasonably serious case of pre-election jitters.

What they said

David Thomas, chief executive:

We start the new financial year with very strong forward sales and are well on the way to meeting our FY17 targets of a 20 per cent gross margin and at least 25 per cent return on capital.

In short

With house prices growing and forward sales rising, Barratt is feeling confident after the election.