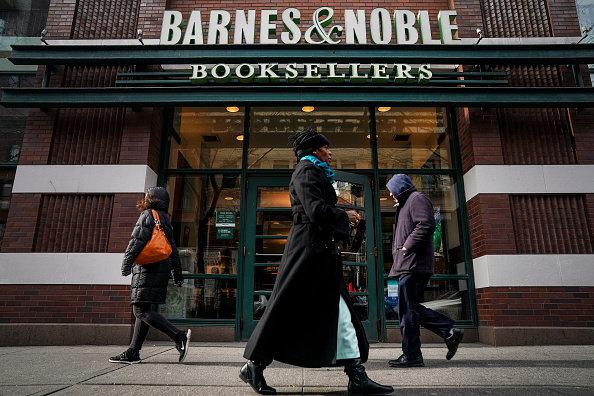

Barnes & Noble bought by Waterstones owner Elliott for $476m

US bookseller Barnes and Noble will be taken private by hedge fund Elliott Management in a $475.8m deal.

The price of $6.50 per share represents a premium of 42 per cent on Wednesday’s price, a day before reports of a potential deal emerged.

Read more: Waterstones acquires Foyles bookshops as it squares up to Amazon

Shares in the New York-listed firm soared 11 per cent in pre-market trading.

Waterstones managing director James Daunt will be appointed as head of the chain when the deal closes in the third quarter of the year. Elliott acquired Waterstones in June last year.

Daunt said the combined companies could counter Amazon’s “siren call” and “defend the continued existence of real bookshops”.

“Physical bookstores the world over face fearsome challenges from online and digital, a complex array of difficulties that for ease and some evident reason we lay at the door of Amazon,” he said.

“Our purpose is to create, by investment and old fashioned bookselling skill, bookshops good enough to be a pleasure in their own right and to have no equal as a place in which to choose a book.”

The deal with Elliott will end Barnes & Noble’s strategic alternatives review that was announced in October.

Read more: Waterstones reads between the lines to go local with unbranded stores

“Our investment in Barnes & Noble, following our investment last year in Waterstones, demonstrates our conviction that readers continue to value the experience of a great bookstore,” said Paul Best, portfolio manager and head of European private equity at Elliot said.

Daunt, who is the founder of the Daunt Books, has been credited with the turnaround of the Waterstones brand. However, he has also come under pressure to agree to pay staff the living wage.