Supermarkets slump as half of UK shoppers head to discounters

FOR THE first time ever, more than half of the UK shopped in either an Aldi or Lidl in the last three months, putting pressure on bigger retailers as the shift toward discount shopping continues unabated.

Sales at Aldi surged by 30.7 per cent in the 12 weeks to 8 December while its smaller discount rival recorded a 15.5 per cent rise, according to the latest figures from retail specialist Kantar.

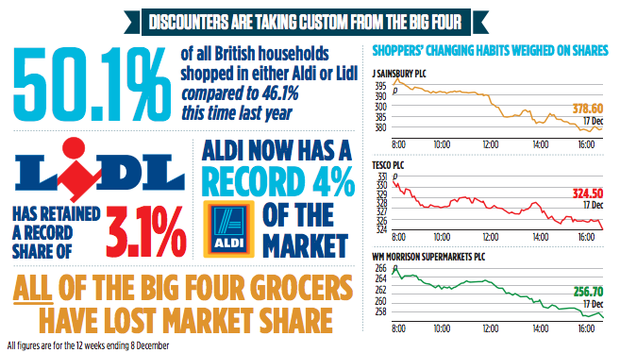

Their unprecedented growth means that more than half (50.1 per cent) of UK households have shopped in their stores in the last three months, up from 46.1 per cent in the same period a year ago. Aldi now boasts a record four per cent share of Britain’s grocery market and could – at current growth rates – soon overtake upmarket retailer Waitrose, whose market share stood at 4.7 per cent.

Shares in the UK’s biggest supermarkets, which all lost market share during the period, fell across the board yesterday as investors acknowledged the new kids on the block. The expectation of weak Christmas retail sales has also weighed on the sector. Sainsbury’s ended 4.2 per cent lower, while Morrison’s lost 2.9 per cent and Tesco almost two per cent. Debenhams’ decision to ask its suppliers for discounts (see page 2) did not help sentiment towards the retailers.

Much of the shift in shopping patterns has come as a result of value retailers winning over the cash-strapped middle classes, who since the recession have been grappling with squeezed household budgets.

But Kantar director Chris Longbottom believes that as the UK economy improves, Britons will continue to stay loyal to discounters.

“At the moment there seems to be nothing stopping their growing … the recession doesn’t make an enormous difference to exactly how much we spend on every day essentials, so it may be that they are here to stay.”

Discounters have been taking advantage of their growing popularity by stepping up store openings. Lidl wants to double its store openings to 30 or 40 a year while Aldi is investing £185m this year in opening 50 new stores, targeting more affluent areas.

“People are initially attracted by our low pricing strategy but it’s the product quality that keeps them coming back,” a spokesperson for Lidl said.

Kantar’s Longbottom added: “Up until now [discounters] have done well on secondary shopping but we were still doing our main shops with the major retailers. Now it does look as though we are putting more and more in our baskets there.”

A spokesman for Aldi agreed: “When new customers come into our stores, they are quickly won over by the quality of our products.”

Meanwhile Kantar’s figures showed all of the big four supermarkets lost market share in the last 12 weeks.

Sainsbury’s was the best performer, although its year-on-year sales growth of 1.8 per cent still lagged the overall market growth of 2.8 per cent.

Tesco sales grew by 0.4 per cent, Asda by 0.6 per cent and Morrisons by 0.8 per cent.