Barclays sets aside £800m for Forex as profits fall 26 per cent

Barclays has put aside £800m to cover potential costs mainly resulting from legal action over alleged foreign exchange manipulation.

The figures

The bank made the announcement as part of its first quarter results, which revealed a 26 per cent drop in statutory profits, which came in at £1.34bn.

The drop was mainly down to one-off items, with the bank paying £150m for the mis-selling of personal protection insurance. Excluding such items, adjusted profit rose by nine per cent to £1.85bn from last quarter. Core adjusted profit before tax rose 14 per cent to £2.1bn.

The company has cut total adjusted operating expenses, which fell seven per cent to £4.1bn from the previous three months.

Why it's interesting

Barclays has embarked on a overhaul of its operations under Antony Jenkins, and it is bearing fruit, as the drop in expenses shows. Other signs of Jenkins's touch include the strength of its investment banking arm, with profit before tax for that unit up 37 per cent.

Investment banking has been given a boost by the European Central Bank's bond-buying programme, as well as the removal of the cap on the Swiss franc.

Most of the talk will be around the money set aside for allegations of Forex rigging. The £800m takes the amount Barclays has put aside to north of £2bn. Barclays is one of five banks implicated in the scandal.

What Barclays said

Antony Jenkins, Barclays chief executive, said:

This performance represents another quarter of continued delivery, with further progress towards becoming the Go-To Bank.

Our Core business, the future of Barclays, generated an adjusted PBT of £2.1bn, up 14 per cent and representing our best quarterly performance in several years.

Resolving legacy conduct issues is also an important part of our plan to transform Barclays. We are working hard to expedite their settlement and have taken further provisions of £800m this quarter, primarily relating to Foreign Exchange.

While we still have much to do, I am pleased with how we've begun 2015.

In short

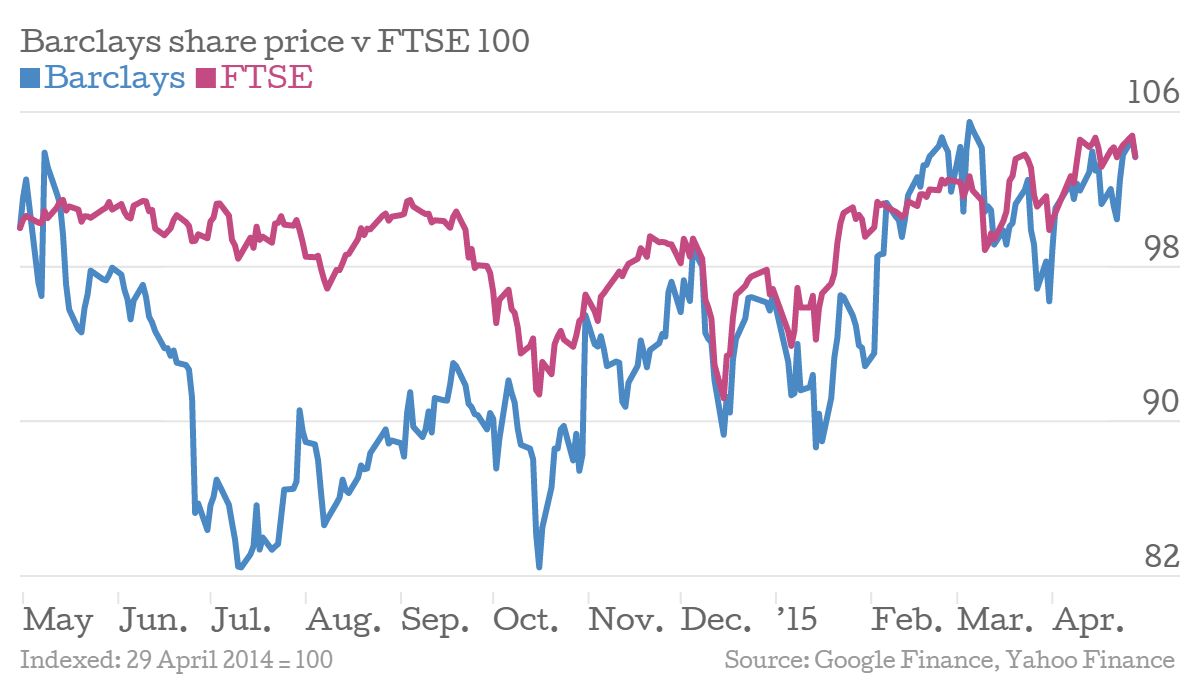

The results are a positive step for the bank, despite the big blow dealt by the Forex scandal. Improvements in adjusted profit give cause for some optimism and that was reflected in Barclays's share price, which was up 0.5 per cent at pixel time.