Barclays looks to grow despite loss

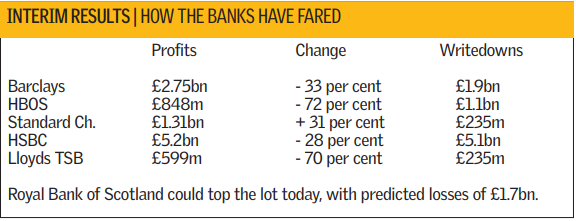

Barclays executives sounded a note of caution yesterday, as the bank posted a 33 per cent decline in pre-tax profits to £2.75bn and took £2.45bn in impairment charges and credit provisions.

Pre-tax profits fell 33 per cent from £4.1bn to £2.75bn, while income remained at £11.8bn and the dividend was stable at 11.5p.

Chief executive John Varley said the bank’s share price and profits decline were “very disappointing” but said Barclays would seek to grow while managing the impact of the credit crunch.

“We need to be realistic about the severity of the environment, but not allow ourselves to be immobilised by that,” he said.

The bank’s £4.5bn rights issue had given it a healthy capital base, he said, with a core tier one ratio of 7.9 per cent, rising to 9.1 per cent following the issue.

The biggest hit came at the bank’s securities division Barclays Capital, which suffered a 68 per cent fall in profits to £524m, as it incurred £2bn of credit market-related losses.

But the group was helped by a strong performance from Barclaycard which saw a 30 per cent increase in pre-tax profits to £388m.

Varley said that measures taken by the Bank of England and the Federal Reserve had eased market conditions and said he would like to see further moves to increase market liquidity.

Analyst Views: Has Barclays escaped the worst of the credit crunch?

Darren Sinden (Lite Financial): “The results were better than indicated and as long as there are no shocks or skeletons in the cupboard to come, then they should do well in the rest of the year. How they do will depend on market movements, which are in the hands of the gods, but Barclays are more worldly wise than some of their competitors and they also have less exposure to the US mortgage crisis.”

Cubillas Ding (Celent): “I think they are bracing themselves for worse to come. The results are reasonable because of their diversified business model. Their presence in the developing markets will help, but with economic conditions getting worse, the times will still be very risky for Barclays.”

Howard Wheeldon (BGC Partners): “Bad as they were, the results are extremely pleasing. The genie has come out of the lamp and there was nothing untoward that wasn’t expected. I think the accusation that they have been slow to write down and that there will be more to come is unfounded.”