Banning proof-of-work is the biggest threat facing Bitcoin

The beating heart of Web3 and the metaverse are blockchains. Blockchain in the beating heart of Bitcoin. Nuclear war could result in the mutually assured destruction (MAD) of much of life and property thus materially impact everything as we know it. Nothing including the metaverse is immune to such destruction.

The EU recently tried to ban proof-of-work (PoW) in a salute to ESG which stands for Environmental, Social and Governance – these three factors make up the criteria investors consider when measuring a company’s sustainability and ethical impact. Peter Theil’s message at the recent Bitcoin Miami conference was that ESG is the primary weapon being harnessed against Bitcoin right now.

“I think that ESG is a hate factory, it’s a factory for naming enemies,” Thiel stated. “What’s the difference between ESG and the CCP?”

The EU does not understand the energy expenditure of Bitcoin. PoW is essential as it stops DoS (denial-of-service) attacks in their tracks, making Bitcoin unique and not just another digital asset. Indeed, Bitcoin is by far the largest, most pristine, and widely adopted PoW entity thus is the most secure. Those who criticise Bitcoin’s energy usage fundamentally misunderstand the point of Bitcoin, failing to see the massive global strategic advantage it gives to those countries who embrace it. The more energy PoW uses, the more powerful it is at physically stopping attacks.

BTC’s PoW vs ETH’s PoS

We are in the “Then they fight you” stage from the famous quote; ESG (Environmental, social, & governance) is the enemy’s weapon of choice as it causes inflation to soar on the basis of bad science. Proof-of-stake (PoS) can’t physically stop DoS attacks plus you pay stakers in fees and debasement to not DoS attack you. Most depend on them because there’s little chance of ever staking more than them. This sounds strikingly how fiat operates. That said, Ethereum can potentially co-exist with Bitcoin since their use cases are vastly different.

Bitcoin’s Lightning network is scaling up fast, however, to the tune of millions of TPS, so should Bitcoin do what Ethereum does at some point while preserving its vast lead over ETH in terms of hash power, thus security, it could overtake Ethereum.

Until then, Ethereum provides the network effect of secure enablement of companies to build on its blockchain while Bitcoin secures the respective country against DoS attacks, protecting its digital assets. In time, with the migration of the masses into the metaverse, short form for the digital universe, the digital space will become exponentially more valuable than the physical space, thus can be used as leverage against attackers to avert a hot war.

ESG brainwashing

Nevertheless, central banks are trying to use mainstream media to brainwash the public into believing PoW is bad for the environment, so they can launch their surveillance PoS CBDCs (central bank digital currencies).

Once governments convince the public PoW is bad for the environment, they are disarming their defence system by minimizing or banning Bitcoin. This is the biggest systemic risk to Bitcoin.

If they try to pivot to a DoS network that is more energy efficient, such as recently with the EU which had a close vote on banning PoW, this is a direct threat to Bitcoin. History shows the disastrous consequences of Emperor Constantine turning down the opportunity to adopt cannons and other new technological Schelling Points that protected their private property.

That said, any country which votes against PoW thus against Bitcoin will be shooting themselves in the foot. China already made a $1 trillion mistake by banning Bitcoin mining.

Bitcoin’s energy use

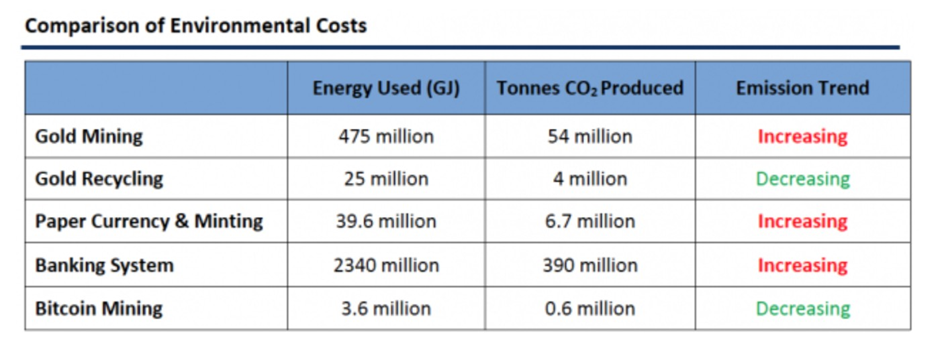

As important as Bitcoin’s energy use is as a key metric, its energy use is scant by comparison to traditional systems such as gold and banking while offering key advantages to any country that chooses to use Bitcoin. It’s energy use is scant and decreases compared to other traditional and legacy systems as shown in the table. Indeed, energy consumption of Bitcoin has been grossly misunderstood as I pointed out in my piece HERE as well as a more recent piece HERE.

El Salvador et al

Disenfranchised countries who are vulnerable to denial-of-service attack at their national treasury are going to recognize Bitcoin’s value proposition, just like El Salvador did. These countries can raise sovereign bonds to raise the development of their hash force. So when you are buying a volcano bond, you are paying El Salvador to build a commercial hash force to defend the world’s access to their private property.

In consequence, other such countries will follow El Salvador’s lead. Just like cannons, airplanes, tanks, and ships scaled quickly, we will see countries scale quickly using Bitcoin for their national defence.

“Haves” vs “have-nots”

Harm comes from soaring populism – the “haves” versus the “have-nots”, for example – which creates social unrest and eventually civil war or revolution. The problem is the “haves” are taking advantage and abusing a systemic control structure where they continue to make themselves the “haves” while not only providing no value to society but also harming society. This control structure can also be seen among “justice” systems in most countries including the US and UK.

We are trapped in a rigged game which is the problem with PoS where the “haves” stay the “haves”. If we can pivot to where the “haves” must provide real value to society to stay the “haves”, then we will dramatically improve the quality of life for the “have-nots”. Web3 can accomplish this as I published recently HERE.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, PhD nuclear physics UC Berkeley/record breaking KPMG audited accts in stocks & crypto/bestselling author/top 40 charted musician/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr Kacher bought his first Bitcoin at just over $10 in January-2013 and contributed to early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in Bitcoin since 2011 to within a few weeks. He was up in 2018 vs the average performing crypto hedge fund (-54%) [PwC] and is up well ahead of Bitcoin and alt coins over the cycles as capital is force fed into the top performing alt coins while weaker ones are sold.

Website 1 of 4: Virtue of Selfish Investing Crypto Reports

LinkedIn: https://www.linkedin.com/in/chriskacher/

Company 1 of 3: TriQuantum Technologies: Hanse Digital Access

Twitter1: https://twitter.com/VSInvesting/

Twitter2: https://twitter.com/HanseCoin

Encyclopedia1: https://de.wikipedia.org/wiki/Chris_Kacher

Encyclopedia2: https://everipedia.org/wiki/lang_en/Chris_Kacher

Author: https://www.amazon.com/author/chriskacher

Composer: https://music.apple.com/us/album/teardrop-rain/334012790

Youtube: https://www.youtube.com/user/teardropofficial

Interviews & Articles: https://www.virtueofselfishinvesting.com/news