Political pressure builds on banks to close gap between savings and mortgage rates

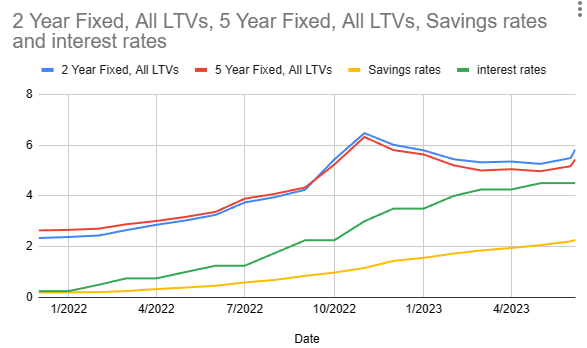

Banks have been shortchanging customers for nearly a year with the average mortgage rates exceeding savings rates by over three per cent since last July.

According to data from Moneyfacts, at the end of last week the average rate on offer for a two year mortgage was 5.87. The average rate on a savings account was just 2.27 per cent.

Since the Bank of England started raising rates back in December 2021, the average gap between savings rates and mortgage rates is 3.3 per cent.

The data demonstrates how banks continue to offer low rates to customers despite pressure from both politicians and regulators.

At a recent Treasury committee hearing, Andrew Bailey, governor of the Bank of England, admitted that the pass through had been “unusually weak”.

The low rates on offer, particularly at the major high street lenders, has attracted cross-party criticism, with the influential Treasury committee demanding that banks “up their game” on savings rates.

Andrea Leadsom, a Conservative MP who sits on the committee, told City AM “its quite clear banks have failed to pass on the rise in interest rates to savers. They’ve only passed them on as fast as could be to borrowers, and therein lies the problem.”

She noted that at a time when the banking sector is fundamentally strong, according to regulators, banks have “the opportunity to actually do the right thing”.

Labour MP Angela Eagle, who also sits on the Treasury committee, told City AM “we’ve all noticed the disparity between the speed with which the costs of higher interest rates are heaped on borrowers and how slowly any of it is shared with savers.”

Eagle highlighted the bumper profits banks have made this year as they’ve benefited from higher interest income. “You don’t have to be a genius to work out what’s going on,” she said.

Although politicians across the political spectrum agree that banks need to do more, there is disagreement about the proper response. Leadsom argued that the “root cause is customer inertia”.

She suggested that if banks were required to inform their customers whether there were better deals on the market and if it was easier to move accounts “without friction”, then things might improve.

Recent research from Atom Bank showed that half the adults in the UK have never switched savings provider, even though three quarters say they would switch to a better rate.

Their research suggested savers could receive more than £200 per year by switching to better deals.

Eagle however suggested people cannot “shop around” that much as its “awkward, time consuming and quite a lot of information you get can be quite misleading”.

Stressing this was not Labour policy, Eagle suggested banks could be forced to match the rate they receive at the Bank of England. “You’ve just got to have something that allows savers to settle on something and be treated fairly without having to spend half their life trawling around websites,” she said.

Many have suggested that the incoming Consumer Duty, the Financial Conduct Authority’s flagship regulatory measure, will force banks to improve. The Duty imposes a requirement to deliver good outcomes for consumers.

A spokesperson for UK Finance, the country’s leading bank lobby, said: “The rates an individual firm offers on its savings and lending products are driven by a number of different factors, not just the Bank of England’s Bank Rate. Saving and lending rates aren’t directly linked to one another and will therefore move at different times and by different amounts. For savings products one key factor that impacts the rate is whether someone wants instant access or can deposit their money for a longer period of time.”

The spokesperson added that the market is “competitive” and encourage customers “to shop around for the product best suited to their needs.”