Banks could drop Facebook over Libra, ING head warns

Banks could have to cut ties with Facebook if it launches Libra without first addressing regulators’ concerns over the possibility of the digital currency being used for money laundering, the head of ING was warned.

Chief executive Ralph Hamers said banks such as ING act as “gatekeeper to the financial system”, and told the Financial Times it would be difficult to provide banking services to a company if there were suspicions their activities were “opening up [the system] for financial… crime.”

Read more: Booking.com owner becomes latest to abandon Facebook Libra

In those circumstances, “we can take measures and exit the client, or not accept the client, so those are discussions you would have to have”, Hamer said.

Asked if the launch of Libra could make it harder for banks to provide services to its creator Facebook, he replied: “Yes, that’s what I think”.

Multiple financial regulators have raised concerns that Facebook’s digital currency could be used for money laundering, or that stablecoins such as Libra could pose a threat to the global financial system.

Stablecoins are tied to fixed-value assets to avoid the dramatic fluctuations in value experienced by cryptocurrencies such as Bitcoin.

A recent G7 report said the Libra project must not go ahead until Facebook demonstrates it is safe and secure, while the head of the Financial Stability Board has warned that global stablecoins “pose a host of challenges”.

The project has been hemorrhaging support recently, with former backers including Paypal, Ebay, Visa and Mastercard all quitting the Libra Association.

Read more: Facebook cryptocurrency Libra dealt fresh regulatory blow by G7

Hamer said ING had decided not to engage with the Libra project because ““We are such a large, regulated institution that you don’t want to risk anything”.

“We’ve said we’ll take a look and see how this develops,” he added.

““From the beginning, we’ve said we’re committed to taking the time to get this right,” a Facebook spokesperson said.

“The Libra Association published a white paper to begin a dialogue with the regulators and policymakers who oversee the stability and security of our financial systems… we will continue to be a part of this dialogue to ensure that this global financial infrastructure is governed in a way that is reflective of the people it serves.”

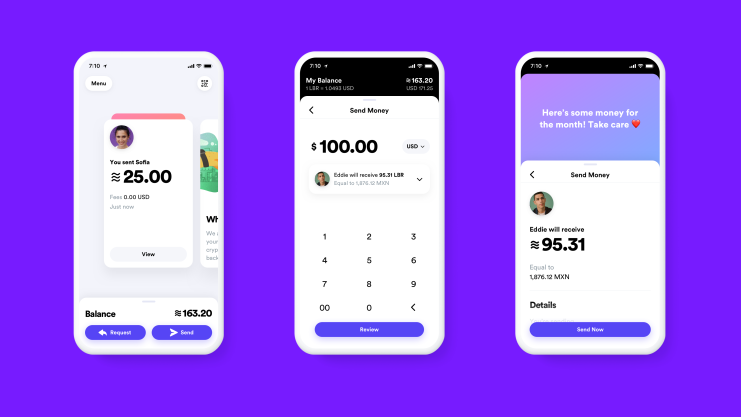

“Facebook will not offer Libra through its Calibra wallet until the Association has fully addressed regulators’ concerns and received appropriate approvals,” they added.