Banks and housebuilders bear brunt of market chaos

Wild swings in UK debt markets and concern over borrowers’ capacity to pay costlier mortgages have whacked London-listed housebuilders and banks this week.

Britain’s biggest property developers have been among the hardest hit listed companies during this week’s market sell-off.

FTSE 100-listed construction firms Taylor Wimpey and Barratt Developments have shed more than 20 per cent each since the mini-budget.

Downbeat market sentiment spread to other segments of the housing sector, with property search site Rightmove tumbling 18 per cent.

Traders are cutting “their exposure to anything linked with the [housing] sector, for fear that we could see a sharp slump in the property market,” Russ Mould, investment director at AJ Bell, said.

Traders are cutting “their exposure to anything linked with the [housing] sector, for fear that we could see a sharp slump in the property market,” Russ Mould, investment director at AJ Bell, said.

This week’s market turmoil has been broadly concentrated in UK debt and currency markets. But, today has been an awful day for London stocks.

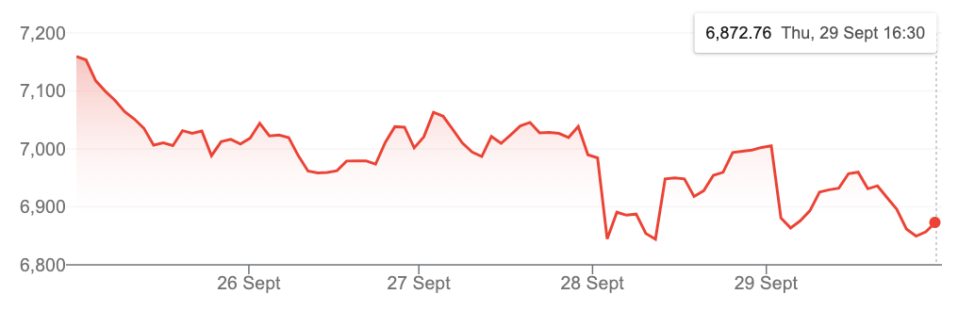

London’s FTSE 100 is down two per cent on the day and four per cent this week.

FTSE 100 has shed four per cent since mini-budget

UK borrowing costs have surged due to chancellor Kwasi Kwarteng’s £45bn worth of tax cuts – coupled with the £2,500 energy bill freeze – expanding government borrowing.

The yield on the 30-year UK gilt kissed a 24-year high this week, driven by vehicles pension funds are invested in being forced to sell assets to pay creditors after prices collapsed. Yields and prices move inversely.

That prompted the Bank of England this week to launch a time-limited £65bn bond buying programme to bring borrowing costs down.

Investors are demanding a higher return to swallow the oncoming wave of government borrowing. The pound also tumbled to a record low against the US dollar, but steadied somewhat during the week.

Rising gilts yields and bets ramping up on the Bank hiking rates to as high as six per cent next year has led economists to warn house prices may tumble more than 20 per cent, weighing on property stocks.

Traders are betting on a 100 basis point move at the Bank’s next meeting on 3 November.

A record daily 935 mortgages from the market earlier this week due to banks sweating over loans’ profitability.

Banks base mortgage costs on rates in financial markets and the amount they pay depositors. Higher interest rates would have squeezed existing products’ profitability, forcing them to pull mortgages.

Meanwhile, experts have predicted borrowers could default on their home loans if rates hit six per cent.

That has soured sentiment to FTSE 100-listed banking stocks, which would suffer heavy losses amid an uptick in mortgage defaults.

Lloyds, which houses Halifax, Britain’s largest mortgage lender, has dropped 13 per cent since last Friday.

NatWest and Barclays have dipped nine per cent and 13 per cent respectively.