Bank urged to ‘release brake pedal’ as starting salary inflation drops to 34-month low

Starting salary inflation fell to a 34-month low in January, according to a new report, as evidence stacks up that the Bank of England’s rate hikes are contributing to increasing slack in the labour market.

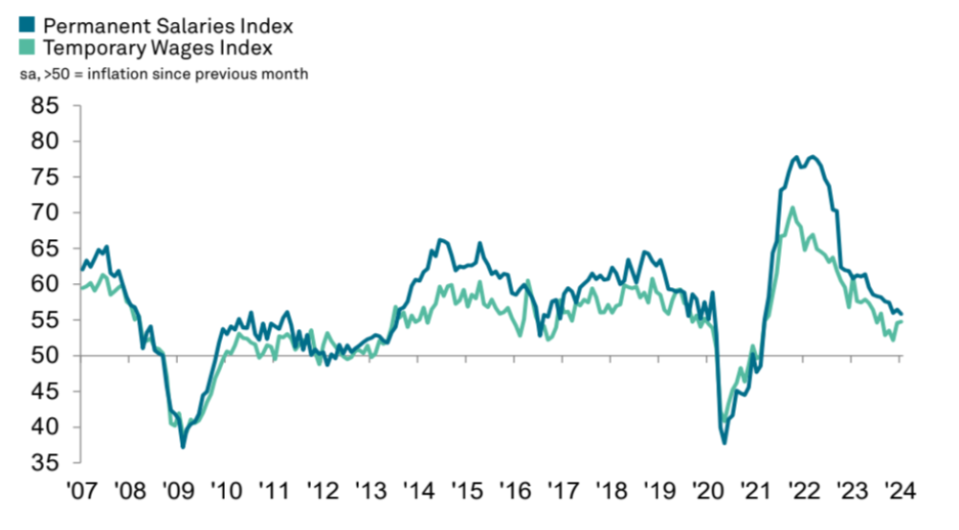

Strong pay growth has concerned policymakers at the Bank who are concerned about the possible implications for inflation. But pay rises have slowed over recent months, and new figures from the KPMG-REC jobs survey suggests it will continue to do so.

With a reading at 55.8, starting salary inflation slipped to its slowest rate since March 2021 and was comfortably below the series average of 57.4. The 50-mark separates growth from contraction.

The still elevated reading reflects the lingering impact of cost-of-living pressures as well as competition for staff. However, the survey suggested that tighter corporate budgets were starting to impact wage offers.

Wage growth for temporary billings meanwhile quickened to a five-month high, but remained below the historical trend.

Neil Carberry, chief executive of the REC, said that with wage pressures easing, the Bank should cut interest rates sooner rather than later.

“Pay has normalised, inflation is dropping and the hiring market has been cooling for a year now – it’s high time that the Bank of England starts releasing the brake pedal on our economy,” he said.

The Bank of England opened the door to cutting interest rates later this year after its latest meeting last week, but policymakers suggested they needed to see further evidence of downward pressure on wages to be sure that inflation would remain at the two per cent target.

Despite the Bank’s historic bout of monetary tightening, the labour market has remained remarkably tight. According to revised ONS figures, unemployment stands at 3.9 per cent.

The KPMG-REC survey suggests this might start to change, with respondents noting a “sharp increase” in candidate availability. Increasing slack has come as hiring has slowed and more workers are laid off.

Demand for permanent staff fell across just over half of the ten monitored job categories in January, with demand falling fastest in retail, construction and IT & Computing divisions.

Temporary vacancies meanwhile expanded at the slowest pace since November 2020.

“We are seeing the number of job seekers increasing as demand softens,” Jon Holt, chief executive and senior partner of KPMG in the UK said.