Bank of Ireland hit as sector struggles

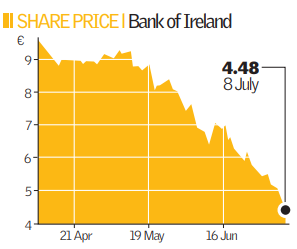

Bank of Ireland’s share price reached a 20-year low yesterday after the governor of its board told shareholders to expect a difficult time.

“It’s time for hard hats I’m afraid. It’s time to run this bank in a very conservative way,” Richard Burrows, governor of Bank of Ireland’s board, told shareholders at the company’s annual shareholder meeting.

Slowing economic growth in its main markets has dented earnings and banking analysts are cutting earnings estimates for 2008/9 by at least 5 per cent.

Davy analyst Scott Rankin said: “Revenue growth is trending worse than in our model.”

The company has seen credit grade slippage over the past quarter, in particular in its business banking portfolios; and is predicting moderation in the growth of the UK and International Corporate Banking business.

Nevertheless, residential mortgage portfolios have proven resilient and customer deposit growth continues. The bank’s procurement of €3bn of term funding from wholesale markets since 31 March, also fuels belief that its capacity to raise term funding through private placement will carry them through a period of market dislocation.

The Bank of Ireland yesterday denied reports that clients with 100 per cent mortgages are falling into arrears; and Burrows insisted that despite the fall in share prices the company is “adequately capitalised” to weather the effects of the current economic downturn; adding it will turn a profit this year.