Bank of Enland’s Gertjan Vlieghe: Pay and inflation are not high enough to justify interest rate hike

The Bank of England’s newest rate-setter Gertjan Vlieghe has said today he is unlikely to vote for an interest rate rise unless pay growth and inflation pick up and growth remains robust.

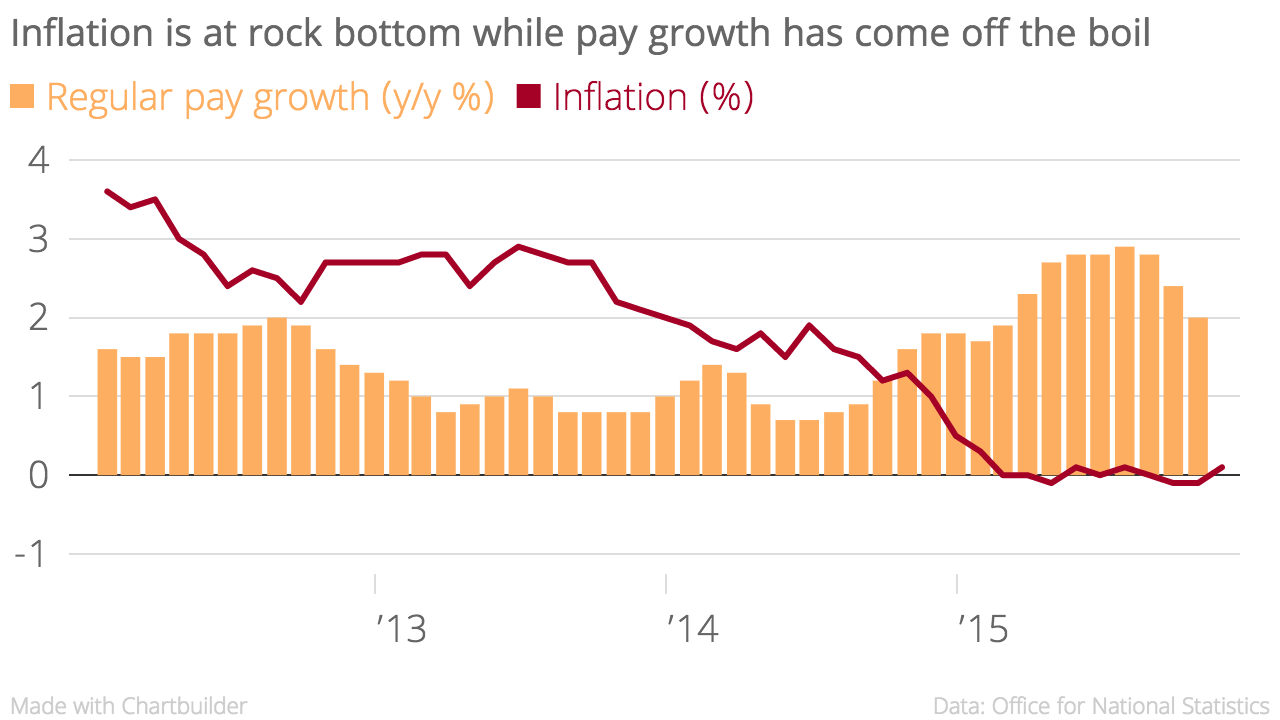

“In order to be confident enough of the medium-term inflation outlook to raise Bank Rate, I would like to see evidence that growth is not slowing further, and that a broad range of indicators related to inflation are generally on an upward trajectory from their current low levels,” the former Brevan Howard senior economist told an audience at the London School of Economics.

"Looking at a range of other pay-related indicators, I do not see convincing evidence yet of upward momentum in pay pressures. With growth still slowing, and inflation pressures either easing outright or disappointing relative to forecasts, I do not believe the conditions are in place to warrant a rise in Bank Rate."

Read more: BoE cuts growth forecasts but holds interest rates

Vlieghe said he was less inclined to raise interest rates because he believed there were bigger risks attached to having rates too high than keeping them too low. He said:

While there is some scope for further stimulus should it be required, both via small further reductions in interest rates and via further asset purchases, I believe our ability as a central bank to stimulate spending is nevertheless smaller than our ability to restrain spending, due to the effective lower bound on interest rates.

I must take account of the fact that we cannot respond to bad news as effectively as we can respond to good news.

Vlieghe said that high levels of household debt, an ageing population and factors related to the distribution of income meant that when rates do rise, they are likely to settle at levels lower than before the 2008 financial crisis. In the decade leading up to 2008, the Bank of England's main policy rate tended to hover between four and six per cent.

“Be prepared for the possibility that real interest rates will remain well below their historical average for a very long time, even with economic growth that is close to or only somewhat below its historical average,” he said.

“Policy rates, when they rise, may not need to rise by much over the coming years. These medium-term considerations make me relatively more patient before raising rates.”

Read more: Why Britain will see a rate rise before the summer

The speech suggests Vlieghe is quite far off from voting for an interest rate hike. His colleague on the monetary policy committee Ian McCafferty was the only member to vote for a rise to 0.75 per cent from 0.5 per cent last week, voted down by the other eight members.

Vlieghe is seen to be the second biggest dove on the monetary policy committee – behind Andy Haldane who said last year that the next move in interest rates could be downward.