Bank of England’s Broadbent urges markets to curb rate expectations

One of the Bank of England’s top officials has today warned markets not to get carried away with the number of rate rises coming down the line.

Ben Broadbent, a member of the monetary policy committee (MPC) and a deputy governor at the Bank, said Threadneedle Street’s internal calculations worked out the response to the energy price shock, the pound’s slide and the government ramping up spending were much tamer than investors’ expectations.

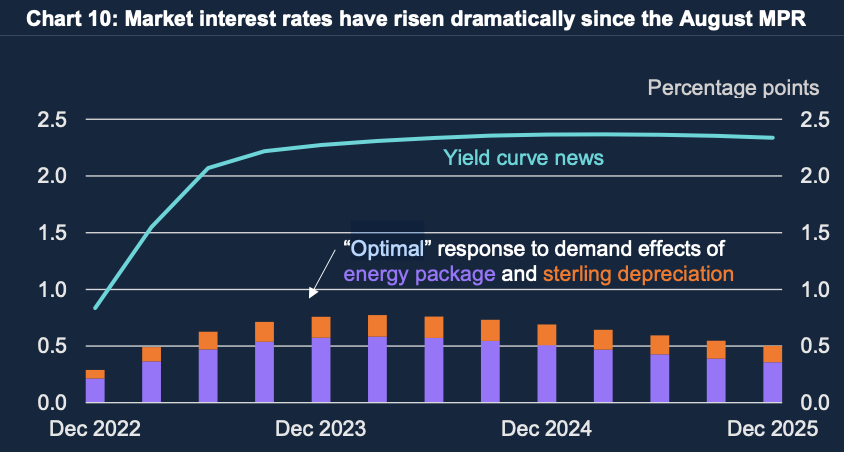

By next December, markets had been pricing in interest rates to have risen around 2.5 percentage points.

But, the Bank thinks a response of nearly one percentage point is more “optimal,” Broadbent said.

Investors think the Bank will lift borrowing costs to over five per cent next year to tame a 40-year high inflation surge and the government delivering a cash injection into the economy through the £2,500 typical energy bill freeze.

This would deal a five per cent hit to the UK economy, Broadbent said.

Markets rate expectations are too high, according to Broadbent

Economists have said Liz Truss’s decision to cap energy bills to prevent a huge shock to household budgets will keep inflation higher for longer by preventing spending from naturally falling in response to elevated prices.

The package “mitigates the severity of the hit to household incomes and thereby supports domestic demand. As the committee noted last month, this would – all else equal – add to inflation,” Broadbent said.

Yesterday, another Bank official, Sir Jon Cunliffe, revealed Truss and her former chancellor Kwasi Kwarteng did not brief the MPC on their £45bn worth of tax cuts on 23 September.

Usually, the treasury gives the central bank a heads up on their tax and spending plans before a budget is delivered.

Broadbent explained the UK has been hit by two severe economic shocks – Russia’s invasion of Ukraine raising energy prices and pandemic disrupting trade flows – that have squeezed living standards.

While these factors have pushed inflation to a 40-year high of 10.1 per cent, “demand will to some degree follow from the very same rises in import costs that have pushed up headline inflation,” which, in time, will force prices back down, he added.

“Equally, if government support mitigates that effect, there is more at the margin for monetary policy to do. The MPC is likely to respond relatively promptly to news about fiscal policy,” he added.

The Bank’s next rate decision is on 3 November. Markets reckon a record 100 basis point hike is nailed on.