Bank of England will have to keep hiking rates to stop inflation hanging around, MPC’s Mann warns

The Bank of England will have to hike interest rates again to stop the UK from being hit by a much stronger inflation surge than expected, one of its top rate setters has said today.

Catherine Mann, an external member of the monetary policy committee (MPC) who has consistently backed steeper rate increases compared to her peers, said the central bank needs to “stay the course” to make sure the rate of price increases does not stick around for longer than necessary.

“In my view the next step in bank rate is still more likely to be another hike than a cut or hold,” Mann added.

Last week, the Bank of England lifted interest rates for the tenth time in a row, up 50 basis points to four per cent, the highest level in 15 years.

Mann voted with the majority for the half percentage point rise, a climb down from previously backing 75 basis point increases at several consecutive meetings.

In the Bank’s monetary policy statement, officials stressed racing wage growth risks embedding high inflation into the UK economy over the long run.

Wages have been rising due to a combination of workers demanding pay increases to protect their spending power from rampant inflation and businesses having to offer better salaries to lure and retain talent amid a tight labour market that is around 500,000 workers smaller compared to before the Covid-19 crisis.

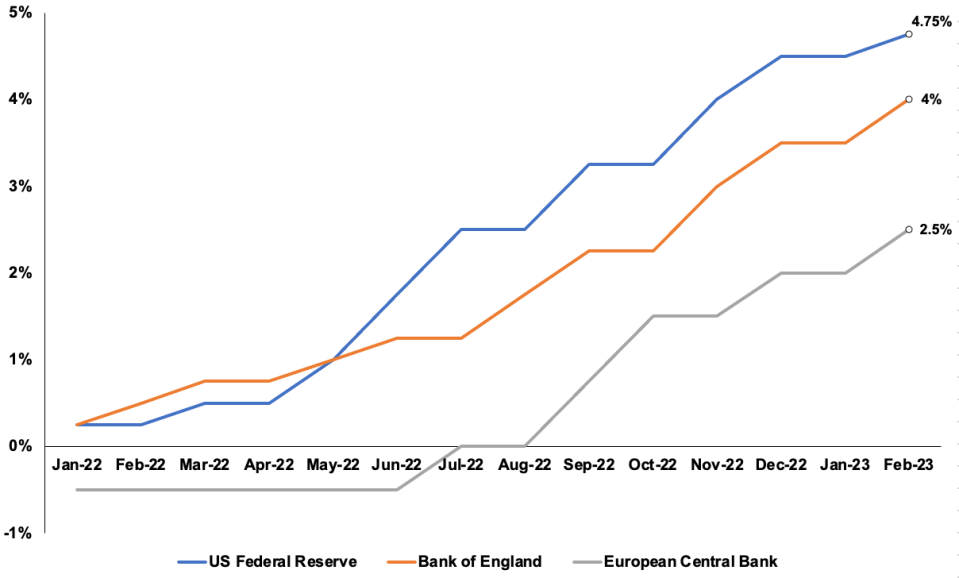

Central banks have raised rates aggressively

Mann repeated that warning today.

“If there is a mismatch between UK labour demand and supply, in part driven by the structural changes in the labour market that Covid and lockdowns brought about, and in part due to the rapid rise in production costs for firms resulting from Russia’s invasion of Ukraine, then wage growth could stay stronger for longer, presenting upside risk to inflation,” she said.

Expectations that the Bank and other monetary authorities are nearing the end of their aggressive interest rate hike cycles have gathered pace of late.

Most of the heavy lifting by central banks was done last year. Bank governor Andrew Bailey and the rest of the MPC raised rates 325 basis points in 2022, including a 75 basis point increase.

The risk of heaping too much pressure on households and businesses via rate rises and tipping the UK economy into a deeper than necessary recession is now much higher, squeezing room for further monetary tightening.

However, Mann pushed back against investors betting on the Bank pausing at its next meeting or cutting rates later this year.

“Uncertainty around turning points should not motivate a wait-and-see approach, as the consequences of under tightening far outweigh, in my opinion, the alternative,” she said.