Bank of England warns of stagnating UK economy and ‘crystallising’ inflation

The UK economy is on course for a slow burning slump over the coming years and scorching inflation has started to “crystallise,” the Bank of England has warned as it lifted interest rates for the 14th time in a row.

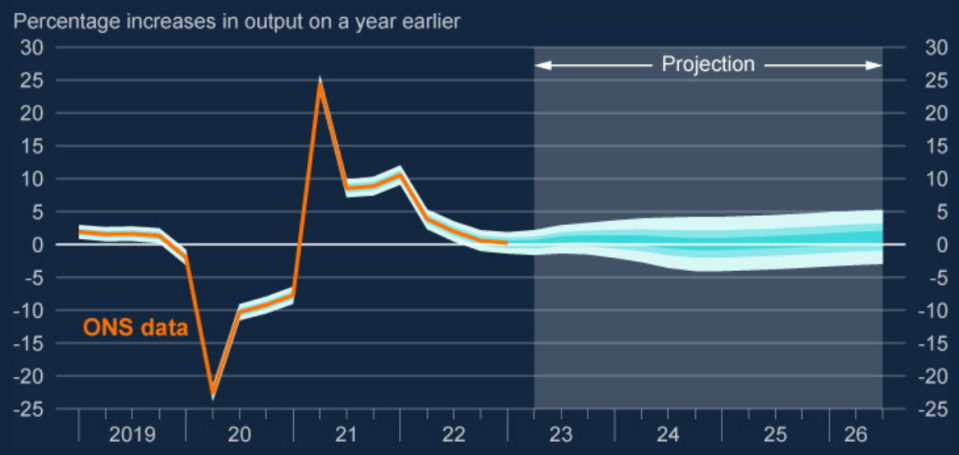

In fresh forecasts released today, the central bank said over the next three years, UK GDP will expand 0.75 per cent slower than it previously thought in May.

Output will jump 0.5 per cent this year and next and then slow to 0.25 per cent in 2025.

Almost all of the growth downgrade has been triggered by higher interest rate expectations on financial markets and the Bank’s efforts to curb inflation with tighter policy.

“Past increases in Bank Rate, and the higher path of market interest rates… will weigh to an increasing degree on UK activity,” the Bank said.

In May, traders thought borrowing costs would peak at just below five per cent.

However, a string of higher than feared inflation numbers in April and May upped rate bets to around six per cent. The Bank uses financial market rate expectations to construct its economic forecasts.

UK GDP is poised to stagnate

Although no recession is projected, the UK gets very close to one at the end of next year. The highest rate of quarterly expansion the Bank thinks the UK will register over the next three years is a little over one per cent near the end of 2026.

Weaker growth is set to lift unemployment a little this year to over four per cent and to a peak of nearly five per cent in three years.

Inflation is poised to be more persistent over the coming years than the Bank expected in May and won’t come back to the two per cent target until the beginning of 2025.

That warning comes despite weaker growth and tighter monetary policy projections, which should put downward pressure on price growth.

Inflation will fall… eventually

The Bank, in new, more forceful language, signalled it is anxious about high wage demands in response to rising prices embedding elevated inflation into the UK economy over the long term.

“Some key indicators, notably wage growth, suggest that some of the risks from more persistent inflationary pressures may have begun to crystallise,” the MPC said in its policy statement.

That reasoning compelled the monetary policy committee today to back a 25 basis point rate rise, taking the UK’s base rate to a fresh 15 year high of 5.25 per cent. It was the 14th rise in a row but lower than the 50 basis point jump that some had feared.

Headline UK inflation fell faster than forecast in June to 7.9 per cent after being stuck at 8.7 per cent for two months.

Unemployment is on the up

However, core and services inflation – which the Bank watches closely – remain elevated at around seven per cent. There is concern that services inflation has yet to pass its peak and that it will barely fall for the rest of this year.

Wages are also growing at a joint record pace of 7.3 per cent. In the private sector alone, they are up 7.7 per cent.