Bank of England to usher in new era of higher interest rates after sending them to near 15-year high today

The Bank of England will rip up the monetary policy order of the last decade and keep interest rates far above their post-financial crisis rock bottom levels over the coming years, new forecasts out today claim.

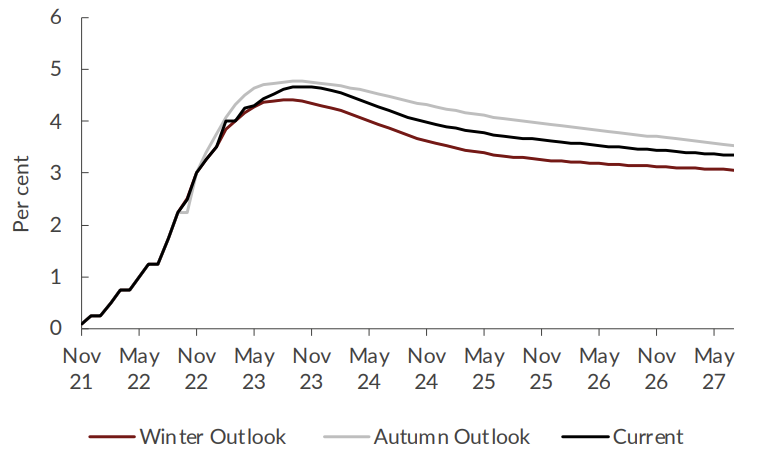

UK borrowing costs are on course to top four per cent for the whole of this year and next and still be running at 3.25 per cent in 2027, according to Britain’s oldest economic think tank, the National Institute of Economic and Social Research (NIESR).

Governor Andrew Bailey and the rest of the Monetary Policy Committee (MPC) – the nine-member group tasked with setting interest rates in the UK – will back a 12th straight rate rise today, likely lifting them 25 basis points to 4.5 per cent, NIESR said.

Such a move would take them to their highest level since October 2008, but another jump of the same magnitude could land in the coming months if inflation sticks around.

If the forecasts play out, Britain’s monetary policy – the Bank of England’s interest rate decisions – playbook of the last decade or so would be ripped up.

That move “represents a regime shift that ought to be handled with great care,” Jagjit S. Chadha, director of NIESR, said.

Between March 2009 and April 2022, UK interest rates were kept below one per cent after they were slashed in response to the 2008 global financial crisis and the Covid-19 pandemic.

Inflation in the UK and across the rich world has returned with a bite, taking off around the end of 2021, initially reignited by a post-lockdown rise in spending colliding with strained global supply chains.

UK interest rates poised for an upward jolt

Russia’s invasion of Ukraine jolted international energy markets, amplifying the nascent inflation surge.

The rate of price increases in Britain peaked at 11.1 per cent, while in the Eurozone and US, it topped ten and nine per cent respectively – all multi decade highs.

In order to put a lid on that inflation resurgence, central banks have been raising interest rates at the quickest pace in 40 years.

NIESR reckons inflation could stay above the Bank’s two per cent until the end of 2024 and that there’s a chance strong wage growth or an escalation in the Russia-Ukraine war could keep it higher for longer.

Britain’s sluggish economic performance since the 2008 financial crisis is poised to continue.

Though the country is set to dodge a recession this year, GDP will only expand 0.3 per cent. In 2024, the economy will expand 0.6 per cent and growth will barely top one per cent in the following three years.

Most of this year’s stagnation has been driven by spending slimming in response to the cost of living crisis, which has swiped £4,000 from the poorest families’ pockets compared to their pre-pandemic finances, NIESR calculated.

To arrest that economic decline, Prime Minister Rishi Sunak – or whoever seizes the keys to Number 10 at the likely autumn 2024 election – needs to ramp up government spending on things likes roads and infrastructure to £435bn over the next five years, NIESR argued.

Under Sunak and Chancellor Jeremy Hunt’s current plans, annual public investment will fall £20bn short each year over the same period.

Global economic growth this year is poised to slump to 2.5 per cent in 2023, the worst rate – stripping out the pandemic – since the peak of the credit crunch in 2009. It will recover marginally to 2.8 per cent next year.

A Treasury spokesperson said: “We are working closely with the Bank of England to bear down on inflation, and remain committed to halving it this year,” a pledge the NIESR said Sunak could miss, forecasting it to be more than five per cent by the end of the year.

Targeting inflation “should not be what the government does,” Chadha said, as it could hinder the Bank of England’s goal to keep it at two per cent.