Bank of England to start cutting interest rates in May with inflation on its way to target

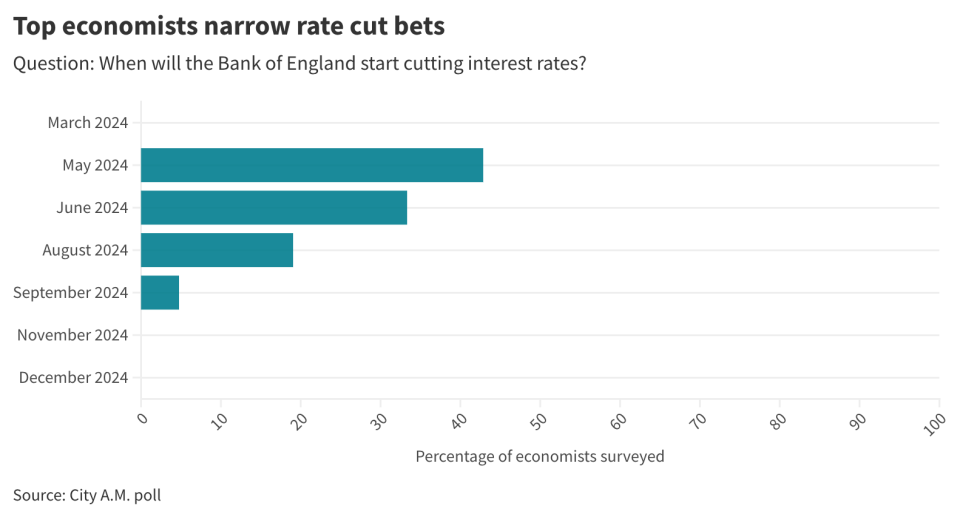

Top economists expect the Bank of England to start cutting interest rates in May while predicting a sharp fall in inflation over the remainder of 2024.

Just under half (43 per cent) of the 21 economists surveyed by City A.M. thought that the Bank would begin relaxing monetary policy in May. A further third thought the first cut would come in June.

Some 47 per cent of economists think the Bank will then cut interest rates twice more in 2024, although 23 per cent thought there would be four cuts and 19 per cent five.

At the beginning of the year, markets were betting that the Bank would start cutting rates in March, but a surprise rise in inflation and comments from members of the Monetary Policy Committee has pushed those bets back.

Nevertheless, it is increasingly certain that cuts are coming. Although Threadneedle Street left rates on hold last week, policymakers opened the door to cutting rates later in the year.

Andrew Bailey, the Bank’s governor, noted the “good news” on inflation while Huw Pill, the Bank’s chief economist, suggested rate cuts were a “when rather than an if.”

The dovish pivot came after a sharp fall in inflation over the final quarter of last year.

The Bank’s November round of forecasts predicted that inflation would only have fallen to 4.6 per cent by the end of 2023. Despite December’s surprise uptick, inflation ended the year at four per cent.

Other measures, such as wage growth and services inflation, have also seen more progress than the Bank expected in November.

Although inflation is likely to rise slightly in January, the Bank now thinks inflation will return to two per cent in the second quarter of this year, aided by a sharp fall in energy prices. Economists largely agree, with over 70 per cent predicting it will fall to target in the spring.

Some economists raised concerns the Bank would be too sluggish in responding to the slowdown in inflation. “It tightened policy too late when inflation spiked and now keeping rates elevated for too long risks needlessly squeezing an already flagging economy,” one said.

However, there is more disagreement about whether inflation will remain sustainably at target. The Bank’s forecasts, which are based on market pricing, suggest inflation will end the year around 2.7 per cent and will remain above target until the end of 2026.

A third of economists surveyed by City A.M. thought that inflation would end the year below two per cent while only two thought it would be at or above the Bank’s own estimate.

“Demand has been dampened by the Bank’s restrictive monetary policy and inflation will likely fall to below inflation by the end of the year,” one economist noted.