Bank of England to send rates to four per cent after Truss energy package

The Bank of England could be forced to hike interest rates to their highest level since October 2008 to offset Liz Truss’s around £150bn energy support stoking inflation, City economists have warned.

Sanjay Raja, senior economist at Deutsche Bank, said borrowing costs may be hoisted to restrictive territory to tame price pressures, possibly reaching a peak of four per cent.

Governor Andrew Bailey and the rest of the monetary policy committee (MPC) will back three more 50 basis point rate rises this year, taking the Bank’s cumulative tightening cycle since last December to 315 basis points.

“The Bank’s credibility is now of paramount importance – especially with government policy pushing nearly 10 per cent of GDP in fiscal loosening in the near-term. This should give the MPC a longer runway for rate hikes,” he said.

Last week, prime minister Truss said energy bills will be frozen at £2,500 for two years. Businesses will receive the same support for six months.

That announcement has prompted economists to warn that price pressures will embed in the economy. The package will largely water down incentives for households to cut spending by pegging energy prices.

Without the new support, Brits were facing the worst hit to their living standards on record.

Bailey and co had been expected to hike borrowing costs by as much as 75 basis points this Thursday. The MPC meeting has been kicked back to 22 September to honour The Queen’s passing.

Economists vary on where they think rates will peak.

US investment bank Goldman Sachs thinks they could hit 3.5 per cent, while consultancy Capital Economics reckon they are steering to three per cent.

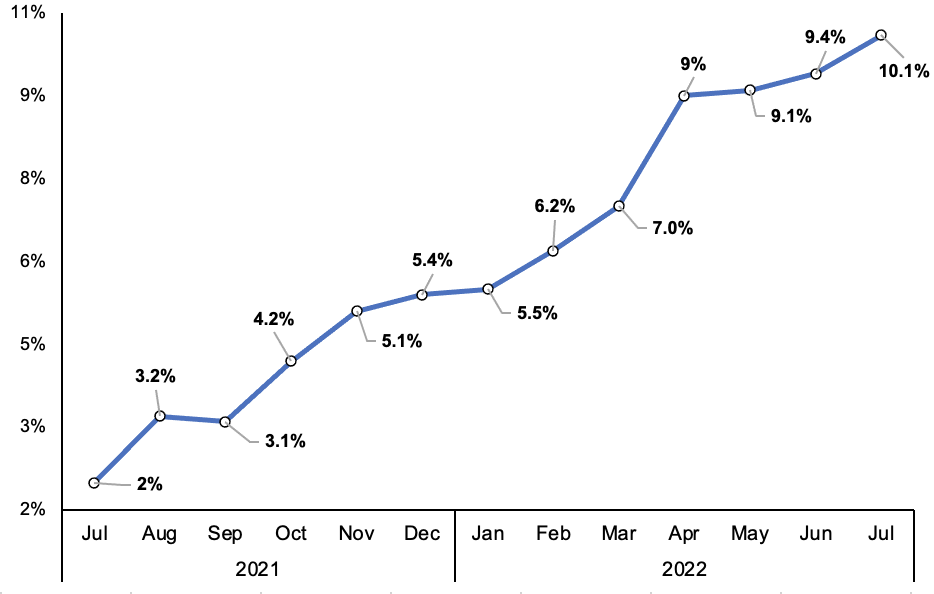

Inflation has soared to a 40-year high of 10.1 per cent. New figures out on Wednesday may nudge above that.

Bank of England has been forced to respond to inflation hitting 40-year high

Truss’s package will artificially keep reported inflation lower than forecast due to it transferring costs from businesses to the government’s balance sheet.