Bank of England to rip up history books at this week’s rate decision

Soaring inflation will force the Bank of England to do something it has never done since it was made independent 25 years ago, City economists are betting.

Governor Andrew Bailey and the rest of the monetary policy committee (MPC) will hike interest rates 50 basis points this Thursday.

The move would also mark the sixth meeting in a row the MPC has raised rates, also a first.

The super-sized rate hike is needed to tame the worst inflation surge since the early 1980s.

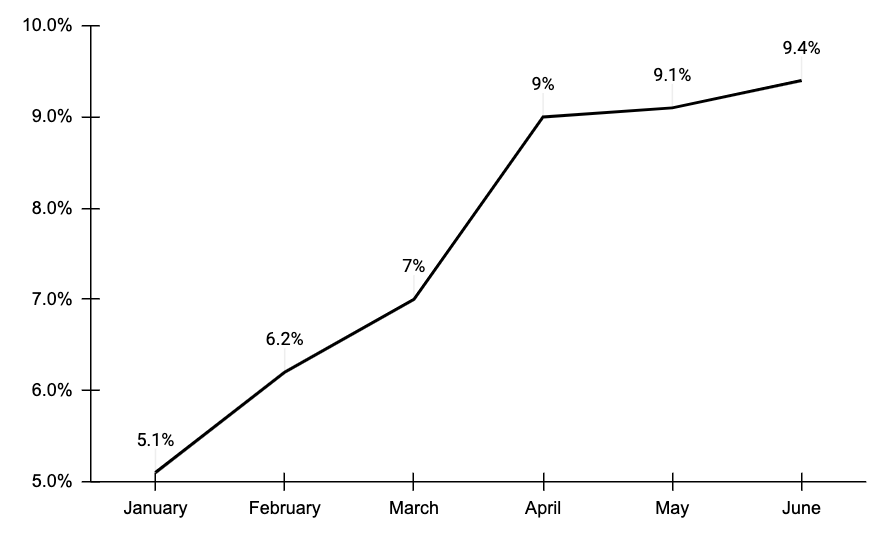

Living costs are up 9.4 per cent over the last year, crimping households and businesses and threatening to plunge the UK economy into recession.

Energy prices have been propelled by Russia’s invasion of Ukraine jolting the European gas market, which could lead to a more than 60 per cent rise in the price cap in October.

A shortage of workers putting upward pressure on wages, compounded by firms passing on higher input costs, may prompt the Bank to hike its expected inflation peak to nearly 12 per cent.

“Lingering price pressures, this time via food, services and energy prices will likely push the Bank’s [inflation] projections up further over the near and medium term,” Sanjay Raja, senior economist at Deutsche Bank, said, adding this will force the MPC to vote 7-2 in favour for a 50 basis point hike.

Raja also said higher market interest rate expectations, now around a 2.5 per cent peak, and a reduction in consumer spending in reaction to elevated prices will prompt the Bank to slash its GDP projections.

A softening in the UK economy is unlikely to deter Bailey and the MPC from signing off further bigger hikes if price pressures firm.

“If there are more signs that higher inflation is continuing to feed into the persistent second-round effects of higher price expectations and faster wage growth… then 50 basis point rate hikes at the September and/or November meetings are possible,” Paul Dales, chief UK economist at Capital Economics, said.