Bank of England to launch another jumbo rate hike to tame over 10 per cent inflation

The Bank of England is set to launch a series of jumbo rate hikes to tame inflation that is beginning to be driven by domestic factors, City economists warned today.

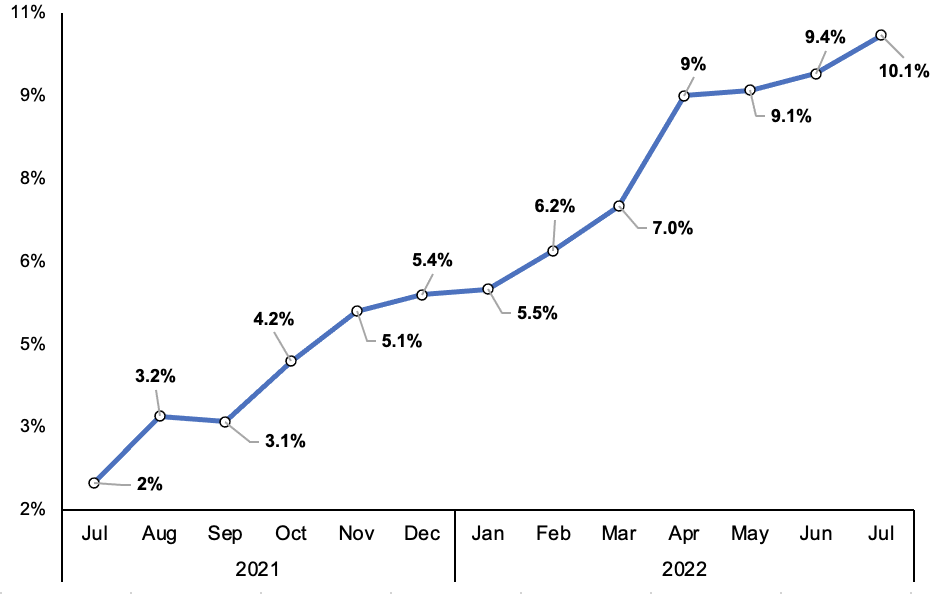

Prices climbed 10.1 per cent annually in July, the fastest acceleration since February 1982 and much higher than the Bank and analysts’ forecasts, according to figures published by the Office for National Statistics (ONS) today.

Britain has the highest inflation rate of any country in the G7.

London’s FTSE 100 closed 0.27 per cent lower, while the pound fell 0.4 per cent against the dollar.

Worryingly, core inflation, seen as a measure of underlying domestic price pressures, jumped to 6.2 per cent, also smashing forecasts.

That upside surprise suggests “that the global drivers of inflation are being replaced by domestic ones,” Ruth Gregory, senior UK economist at Capital Economics, said.

Annual CPI UK inflation

The cost of buying services climbed to 5.7 per cent, a 30-year high, while restaurant and hotel prices lifted nearly nine per cent.

The Bank has said raising interest rates is an ineffective tool to tackle international inflation, such as higher energy prices caused by Russia’s war with Ukraine and a surge in demand after the Covid-19 unlocking.

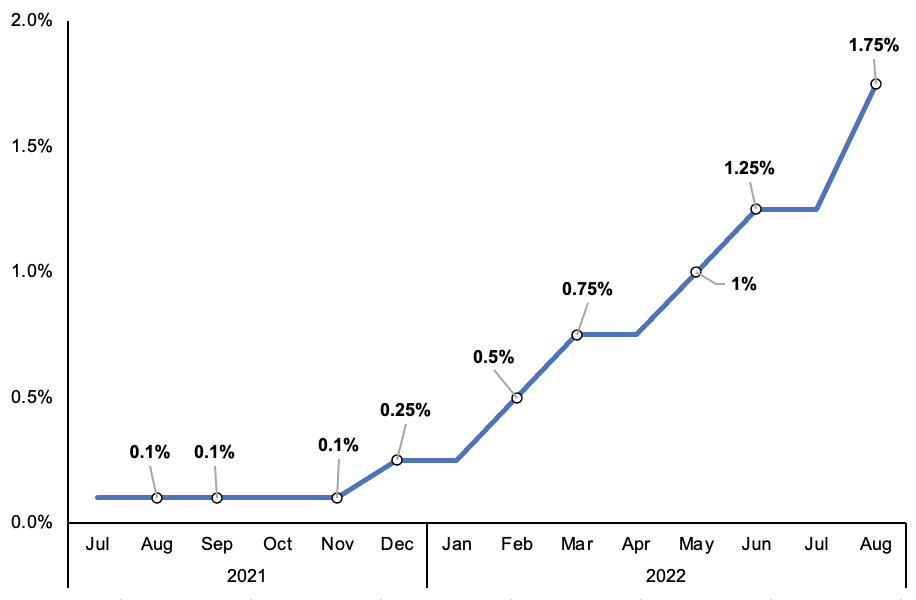

The monetary authority raised borrowing costs 50 basis points earlier this month for the first time in 25 years of independence, marking the sixth rise in a row and taking rates to 1.75 per cent.

However, today’s figures show price pressures are spreading to areas of the economy where governor Andrew Bailey and co can influence.

“The [Bank] seems to be sensitive now to any signs of increasing persistence,” Robert Wood, UK economist at Bank of America, said, adding rates will jump 50 basis points next month and November.

Thomas Pugh, economist at RSM UK, said: “There is plenty of evidence now that inflation is becoming more broad-based”.

In its policy announcement earlier this month, Threadneedle Street said it would act “forcefully” if inflation keeps rising.

Money markets are now pricing in rates to peak at 3.75 per cent after today’s huge inflation overshoot, the highest level since October 2008.

The monetary policy committee earlier this month warned Britain is headed for a 15-month long recession, caused by consumers cutting spending in response to historic high inflation eroding their finances.

Central banks rarely lift interest rates during a recession as it heaps more pressure on household and businesses’ finances.

The cost of living is expected to top 13 per cent in October when household energy bills soar around 70 per cent to over £3,500. Analysts at Wall Street bank Citi said it may nudge above 15 per cent in January.

“Higher base rates, falling consumer confidence, and a weak external environment look certain to push the UK into a period of stagflation,” Yael Selfin, chief economist at KPMG UK, said.

UK interest rates

Whoever wins out of Tory leadership hopefuls Liz Truss and Rishi Sunak faces the daunting prospect of trying to tackle a recession on par with the sterling crisis driven slump of the 1990s.

Truss has argued cutting taxes will boost growth and committed to supply-side reform to curb future price rises.

Sunak has pledged to increase support for the poorest households to shield them from the energy bill spike.

Chancellor Nadhim Zahawi said: “Getting inflation under control is my top priority, and we are taking action through strong, independent monetary policy, responsible tax and spending decisions, and reforms to boost productivity and growth.”