Bank of England successfully kicks off QT with over subscribed £750m bond sale

The Bank of England today successfully sold hundreds of millions pounds of government debt in the first stage of winding down stimulus that has propped up the economy in the aftermath of the financial crisis and during the pandemic.

Some £750m bonds ran off the Bank’s balance sheet today, with the auction heavily over subscribed in a sign markets are happy to swallow more UK government debt.

The bid to cover ratio – a measure of demand for UK government bonds, or gilts – topped 3, with the Bank receiving £2.44bn worth of bids for the debt.

UK bond markets responded well to the first tranche of sales. The yield on the 10-year gilt fell. Yields and prices move inversely.

Despite the sale, the Bank still owns over £837bn of government debt.

The Bank of England – and the world’s top central banks such as the US Federal Reserve and European Central Bank – in the aftermath of the financial crisis and during the pandemic hoovered up government bonds to support spending and bring down interest rates, a scheme known as quantitative easing (QE).

QE is designed to suppress borrowing costs by helping bondholders sell their assets without needing to offer a high return through increasing demand.

The programme pumps money into financial institutions by central banks exchanging government debt for cash, which, in theory, should incentivise firms to lend to businesses and households.

QE was initially intended to cushion economies from severe shocks. However, it has been the linchpin of the global financial system since it was deployed at scale over a decade ago.

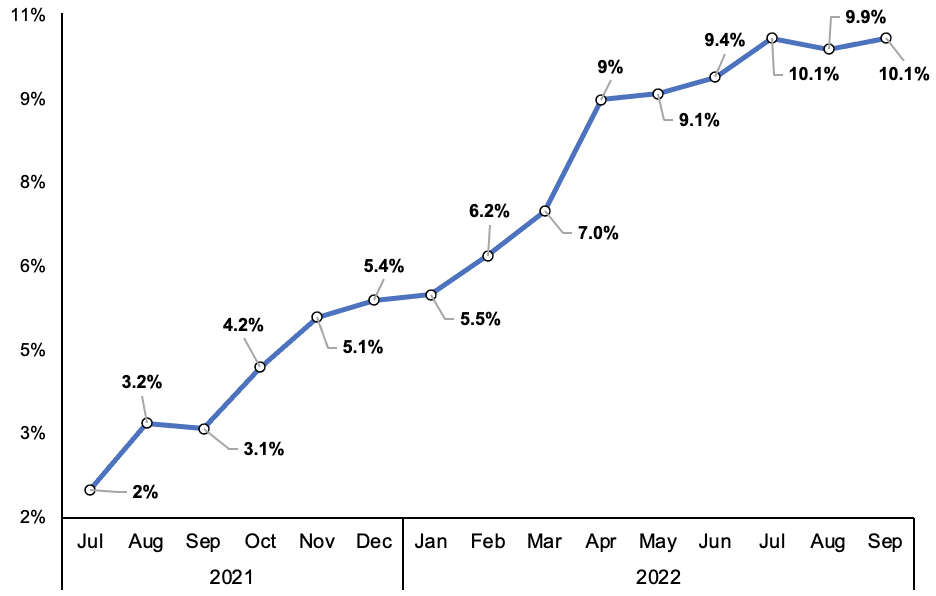

The Bank has started shrinking its balance sheet in response to inflation surging to a 40-year high of 10.1 per cent.

BoE is tightening to tame an inflation surge

Selling bonds, known as quantitative tightening (QT), is thought to raise market interest rates and discourage bank lending, the reverse of QE.

Tighter financial conditions should reduce demand in an economy and tackle inflation, if supported by central banks raising their base interest rate.

Threadneedle Street has lifted base rates seven times in a row to 2.25 per cent. It is expected to hike rates 75 basis points on Thursday, which would be the biggest upward move since 1989.

However, Antoine Bouvet, senior rates strategist at ING, told City A.M. the Bank today sold bonds that were already in high demand, meaning it could run into trouble once longer-dated debt sales begin.

He said ditching bonds before the Bank’s next meeting on Thursday and the budget on 17 November “is a gamble”.

“So far so good I would say but clearly gilts cannot afford an underwhelming budget or investors questioning the BoE’s tightening strategy,” he added.