Bank of England signs off biggest rate hike in nearly 30 years

The Bank of England today ripped up the history books and hiked interest rates by the largest amount in its 25 years of independence.

The nine-strong committee of rate setters, including governor Andrew Bailey, backed a 50 basis point rise by 8-1 in a bid to step up their battle against the worst inflation surge in the UK in recent memory.

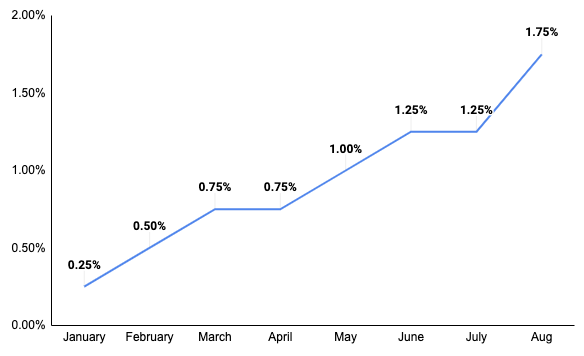

Borrowing costs are now 1.75 per cent, up from 1.25 per cent and the highest since December 2008.

The move marked the sixth meeting in a row Bailey and co have lifted rates, also a first.

Inflation in the UK has climbed to a 40-year high of 9.4 per cent, the highest in the G7 and nearly five times its two per cent target.

UK interest rates

But, living costs are forecast to rise by a peak of over 13 per cent in October, the quickest acceleration since September 1980, forcing the UK into a protracted recession comparable to the downturn after the financial crisis.

The Bank’s forecasts show the country is set to plunge into a long period of stagflation, when prices surge but growth slumps.

It is the first time the monetary policy committee (MPC) has hiked interest rates while warning a downturn is coming since it was created in 1997.

The economy will contract from the final three months of this year through to the final quarter of next year.

The Bank also committed to more steep rate hikes despite projecting a drawn out slump.

“The committee will be particularly alert to indications of more persistent inflationary pressures, and will if necessary act forcefully in response,” it said it its monetary policy report.

The Bank joins the world’s other top central banks, the US Federal Reserve and European Central Bank (ECB), in raising rates by larger than usual increments. They tend move raise rates by 25 basis points.

Monetary authorties have been forced to pull ultra-stimulative policy that has propped up the global economy since the financial crisis due to inflation climbing far above their two per cent targets.

US rates have climbed 75 basis points for two months in a row. The ECB last month marked its first rate hike in over a decade with a shock 50 basis point move.

One member of the MPC, Silvana Tenreyro, voted for a 25 basis point rise.

The Bank also announced its will begin selling bonds the hundreds of billions of pounds of bonds it hoovered up to support the economy through the Covid-19 crisis after its September meeting.