Bank of England shirks historic rate hike despite warning of longer inflation

The Bank of England today shirked the biggest interest rate hike since the late 1980s despite inflation threatening to run hot for months.

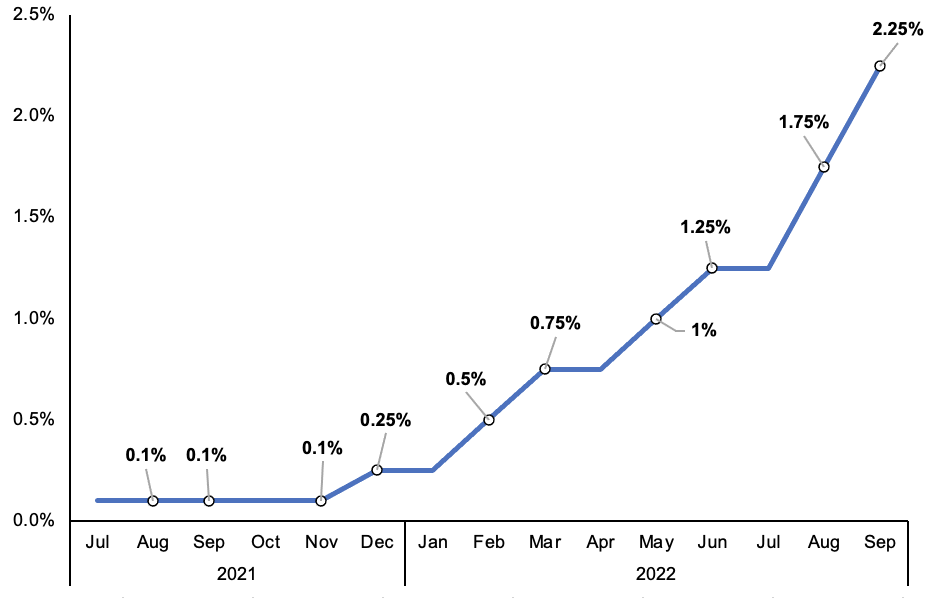

Borrowing costs climbed 50 basis points to 2.25 per cent, their highest since November 2008 and the seventh rise in a row, the Bank announced.

Before the decision, City economists and markets had warned governor Andrew Bailey and co could slam the brakes on the economy with a huge 75 basis point rise to prevent inflation being stoked by prime minister Truss’s £150bn energy support package.

UK interest rates have rocketed this year

However, the Bank drew attention to the prime minister’s spending splurge, warning it will “add to inflationary pressures in the medium term”.

The comments illustrate fiscal and monetary policy are pulling in different directions. The Bank is attempting to push prices down by taming spending, while the government is trying to protect household and businesses’ finances.

Three members of the nine-strong rate setting committee backed the larger move, underlining the Bank’s anxiety over inflation becoming a long-term problem is intensifying.

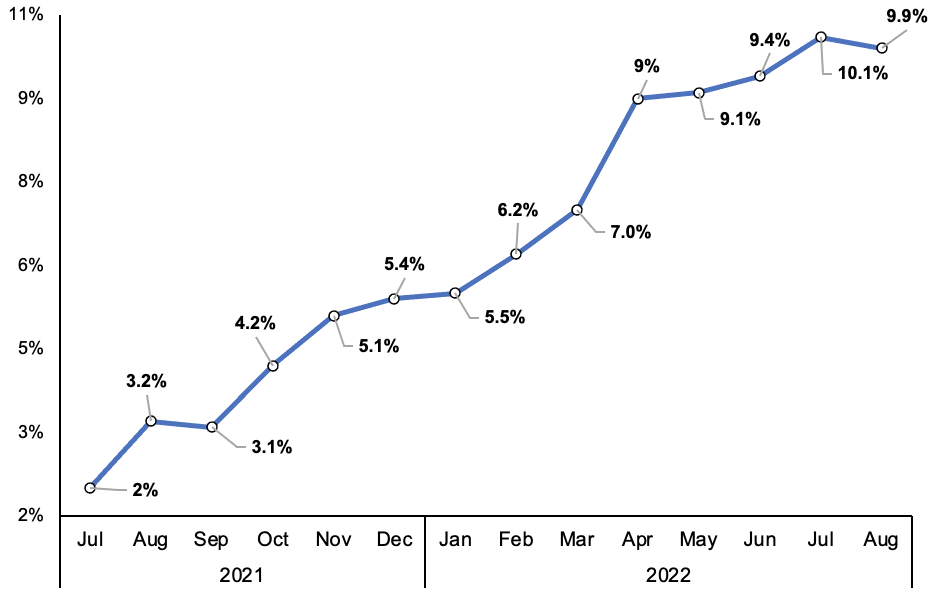

The cost of living has surged to nearly five times the Bank’s two per cent target, forcing rate setters to heap financial pain on households and businesses in a bid to cool the economy.

They have now lifted rates 215 basis points since last December. Today marked the second 50 basis point rise in a row, but such moves are rare. It matches the biggest hike in the Bank’s 25 years of independence.

Successive large hikes have been “driven by the government’s plans to dramatically loosen fiscal policy,” Paul Dales, chief UK economist at Capital Economics, said.

Kitty Ussher, chief economist at the Institute of Directors and a former Labour MP, said Truss’s “stimulus package” forced the Bank to judge “rates need to continue rising”.

Markets think they could peak at near five per cent next year.

Higher interest rates make it more attractive to save and costlier to borrow, curbing spending and prices.

Britain may already be in the teeth of a recession, caused by firms and consumers retreating in response to higher prices and rates, the Bank forecast.

Prices are up 9.9 per cent over the last year, the fastest acceleration in nearly 40 years. Inflation has been above the Bank’s goal since July 2021.

Annual UK CPI inflation

London’s FTSE 100 dropped after the announcement, while the pound lost some early gains, but was still up against the US dollar.

The cost of living support package will shield household and businesses’ finances from the energy price shock, likely keeping demand far above supply.

The prime minister has frozen household energy bills at £2,500 for two years and will cover around half of the cost of businesses’ gas and electricity bills for six months.

Without the extra support, Brits were staring down the barrel of the worst hit to their living standards on record.

Her chancellor, Kwasi Kwarteng, will tomorrow elaborate on those plans at a mini-budget. He will inject further stimulus into the economy by reversing the 1.25 percentage point national insurance hike and six percentage point corporation tax rise.

At its last meeting in August, the Bank forecast a 15-month long recession beginning at the end of this year. It also said inflation was set to peak above 13 per cent.

Truss’s measures will probably shorten the slump and curb the inflation summit to 11 per cent, the Bank said.

For the first time in years, the monetary policy committee was split three ways. Five backed a 50 point move, including governor Bailey, while three favoured the steeper rise. One backed a 25 basis point increase.

The Bank will also start selling bonds, a process known as quantitative tightening, it said.