Bank of England risks steering UK into needless recession with more interest rate hikes

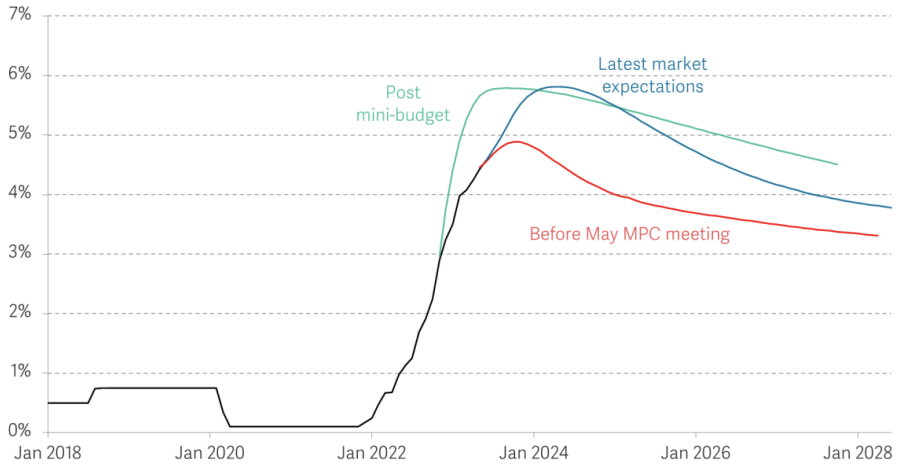

Back in November, the Bank of England took the highly unusual step of explicitly telling financial markets to calm their sky high bets on where interest rates might end up.

“Should the economy evolve broadly in line with the latest monetary policy report projections, further increases in bank rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets,” the monetary policy committee (MPC) said.

That announcement came alongside the first 75 basis point rate increase in the Bank’s 25 years of independence.

Market exuberance was such that Governor Andrew Bailey and co had to guide traders’ expectations lower. And – aided by Chancellor Jeremy Hunt ditching most of Liz Truss’s tax cutting measures – it worked. Gilt yields settled and the pound recovered. Yet look where we are now, just a few months later.

Yields on UK debt are above their post mini-budget levels, trading around five per cent. Peak rate expectations are just below six per cent. Mortgages rates are over that threshold.

Over the last month, a string of data has printed much hotter than expected. Wages are racing at the second fastest pace on record, unemployment is falling, core inflation is climbing and the services sector is growing quickly again.

As such, market participants have recalibrated their view on the UK economy to bake in what Samuel Tombs of Pantheon Macroeconomics described last week as a “unique” and “ingrained” problem with high inflation.

Eyes now turn to the Bank’s rate decision on Thursday. Some corners of the market think a 50 basis point rise is coming. Such a move may be interpreted as the MPC panicking, though it would show they are keen to rid inflation from the system.

A 25 point jump to 4.75 per cent is more likely with a nod to more such rises to come.

Market expectations for Bank Rate have risen sharply…

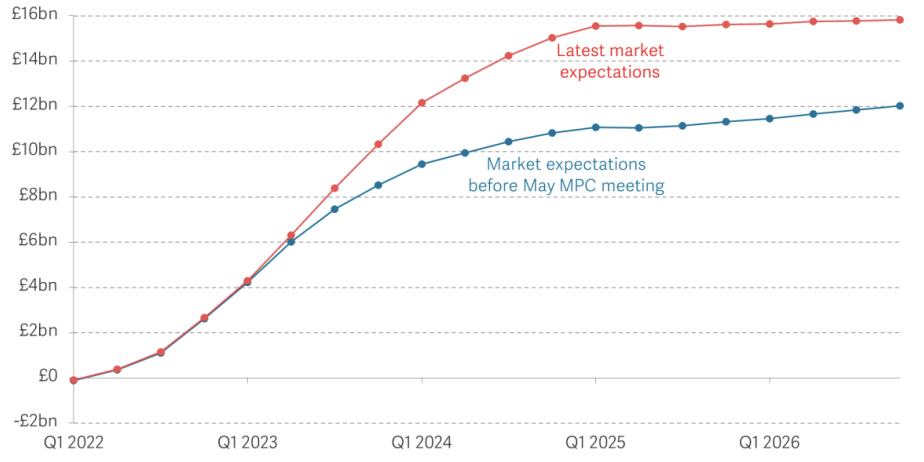

Existing pressures in the economy – most of which are ripening before being released via the mortgage market in the second half of this year – would amplify if the Bank meets present market expectations and hoists rates much higher.

For the MPC, it’s all about whether they can finally pump up unemployment and ease upward wage pressure.

In that scenario, spending would slow due to consumers losing their job or fretting about whether they’re for the chop. Monetary policy is a tough medicine.

The wave of more than 1m Brits that are poised to remortgage this year on to much steeper rates will have two choices: sell up or be a more prudent homeowner.

Mortgage affordability – whether or not prospective buyers can viably take on home loans – would be crimped even further, sucking demand out of the market.

“Should this scenario materialise, it would have important implications for property markets. On the residential side, our baseline forecast assumes a peak-to-trough fall in house prices of just over nine per cent, with a lengthy period of low activity,” Oxford Economics said in a note recently.

They also estimate the commercial real estate sector – offices and the like – would come under intense pressure, forcing up defaults. That would surely instil greater caution among banks, limiting credit supply to the economy.

… which will raise mortgage payments (increase in aggregate repayments compared to Q4 2021)

Inflation will fall even if the Bank leaves rates at their current level of 4.5 per cent – Threadneedle Street reckons it will be back to the two per cent target by 2025 and then dip below that level if borrowing costs remain unchanged.

But the chances of the MPC making a big mistake and heaping too much pressure on the economy are mounting.

Absent from the MPC’s interaction with the general public and City since they started raising borrowing costs in December 2021 has been effective communications that set out clearly its preferred rate path.

As a result, the market has been given “carte blanche” to run wild, Jagjit Chadha, director of the National Institute of Economics and Social Research put it on Twitter.

Fulfilling market expectations by jacking up rates to as high as six per cent may now be unavoidable.

“This increases the probability of a recession, needlessly,” Chadha warned.

WHAT I’M READING

Experts at investment bank Nomura have produced a handy primer on what has caused the Japanese economy to be gripped by three decades of sluggish growth after experiencing a post-Second World War upsurge. It’s a useful tapestry that earmarks each policy decision over the past 30 years or so that have created deflationary dynamics that is driving the current economic slump. It’s worth remembering the Bank of Japan has ignored the uptick in prices over the last year and a half.