Bank of England record recession warning reinforced by fresh research

A new survey out today reinforces the Bank of England’s warning last week that the UK is headed for the longest recession on record.

The economy last month was functioning at the same level as during the teeth of the 2021 winter Covid-19 lockdown, according to consultancy BDO.

The firm’s output index, which measures the size of the economy, slumped to 93.1 last month.

Official figures from the Office for National Statistics out on Friday are likely to show the economy slumped 0.4 per cent in September and over the last quarter, meaning BDO’s survey signals the UK may tip into a technical recession this winter if output does not recover.

Economists generally define a recession as two consecutive quarters of contraction.

The fresh research underscores the sharp swing in fortunes the UK economy has undergone over the last year or so.

At the beginning of this year, few experts were expecting the country to tip into recession or suffer huge interest rate rises.

However, a combination of Russia’s invasion of Ukraine jolting international energy markets, Liz Truss’s £45bn of tax cuts in her mini-budget spooking financial markets and ongoing supply chain pressures have sent inflation to a 40-year high of 10.1 per cent.

In response, consumers and businesses have slashed spending and the Bank has lifted interest rates eight times in a row, including the biggest rise in over 30 years last week at 75 basis points, heaping pressure on the economy.

In forecasts accompanying last week’s rate announcement, governor Andrew Bailey and co judged the UK will suffer a two year long recession if interest rates hit 5.25 per cent, which would be the longest contraction in around a century.

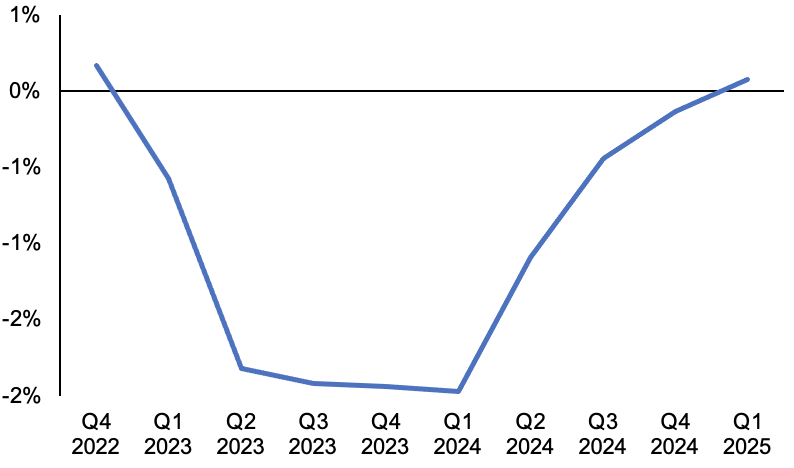

Bank of England’s GDP forecast

The economy would shrink nearly three per cent under that scenario. The Bank has insisted it will not lift borrowing costs that high.

Threadneedle Street’s projections were produced without accounting for prime minister Rishi Sunak and chancellor Jeremy Hunt likely launching £50bn of tax hikes and spending cuts at 17 November’s budget.

The scale likely of fiscal tightening would squeeze households and businesses, casting doubt over whether the Bank’s tough recession projection would not materialise if rates stay at three per cent.

Analysts said the pound’s weakness will raise product prices during the Christmas period, possibly sparking a consumer spending slowdown.

“A weaker currency and drop in consumer spending power will have real and tangible consequences for firms relying on imports or customers in the retail and services sector, alongside the knock-on effects of managing political and economic uncertainty,” Kaley Crossthwaite, partner at BDO, said.

Research out from consultancy Deloitte today also found Brits intend to tighten their belts over the festive period due to the cost of living crunch squeezing their finances.

Sterling has rebounded sharply from the record low it hit against the US dollar in the aftermath of Truss’s mini-budget.