Bank of England policymaker: ‘Dragons of market discipline are alive and well’

The recent turmoil in the UK’s bond market demonstrates that the “dragons of market discipline are alive and well,” a policymaker at the Bank of England said today.

In a speech at Fitch Ratings, Carolyn Wilkins, an external member of the Bank’s financial policy committee (FPC), acknowledged January’s jitters in the gilt market.

“Recently we’ve seen orderly movements in global yields as one would expect given news that markets consider relevant to the global outlook.”

“There have been spikes in yields in a number of individual countries in recent years, including the UK, that indicate the dragons of market discipline are alive and well,” she said.

UK government bonds suffered a bruising sell-off, driven largely by the expectation that US interest rates would remain higher for longer due to stubborn inflation.

The yield on the 10-year gilt hit 4.93 per cent, its highest level since the financial crisis. Gilt yields are closely tied to movements in the US Treasury market.

Yields have recovered almost all of the lost ground on the back of soft economic data, but the FPC is still concerned by the elevated levels of public debt, both in the UK and elsewhere in the world.

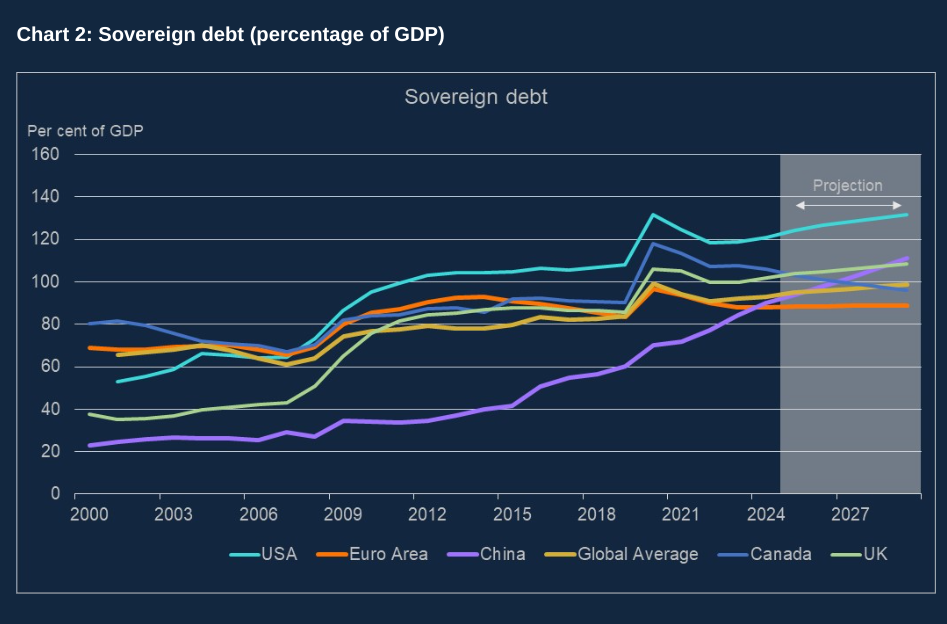

“The FPC that I sit on is of the view that global sovereign debt risks are material,” Wilkins said, noting that global public debt will likely approach 100 per cent of GDP by the end of the decade.

“Heightened concern among market participants about the sustainability of public debt outside the UK could spill over to the cost of debt service for the government, households and businesses within the UK,” she added.

A number of commentators have expressed concern about rising debt burdens in advanced economies in recent months.

The Congressional Budget Office warned on Friday that US government debt would surpass its post-World War II record, even before taking into account the effect of Donald Trump’s tax cuts.

“The fiscal situation is daunting, the debt trajectory is unsustainable,” Phillip Swagel, director of the CBO said following the release of its report.

In the UK, the Office for Budget Responsibility (OBR) projects that national debt will rise to 270 per cent of GDP over the next 50 years.

Ray Dalio, founder of Bridgewater Capital, warned that the UK was at risk of a “debt death spiral” as the government has to shell out more to service its debt.