Bank of England interest rate hikes would squeeze Jeremy Hunt’s room for tax cuts by £8bn, City economist claims

The Bank of England could squeeze Chancellor Jeremy Hunt’s room to cut taxes in the run up to the next general election if it keeps hiking interest rates to tame inflation, a City economist has calculated.

Officials at Threadneedle Street would swell Britain’s debt interest bill by around £8bn if they send borrowing costs to five per cent, in line with market expectations.

That’s according to Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, who said that if the country’s official forecaster, the Office for Budget Responsibility (OBR), were to “recast the numbers today… [it] would increase its forecast for debt interest payments” in the current fiscal year.

The claim comes after numbers from the Office for National Statistics yesterday found the UK borrowed about £13bn less than the OBR projected at the budget last month, sparking a wave of City analysts to predict Hunt will offer tax cuts in the run up to the next general election – which must be held by January 2025 – in a bid to drum up support for the Conservatives, who’ve lagged Labour in the polls for about a year.

Britain borrowed about £139bn in the year to March, lower than the budget watchdog’s expectations.

Inflation has topped experts’ forecasts so far this year, hovering in the double digits at 10.1 per cent in March, prompting markets to step up their peak Bank Rate bets to five per cent.

That higher rate path, compounded by an old measure of inflation – the retail price index – which the government uses to upgrade interest payments on a big chunk of the country’s debt stock, is poised to raise the amount of cash the government reimburses investors.

Tombs also said the OBR’s GDP growth expectations are too optimistic. They think the economy will shrink 0.2 per cent this year and then swing back to 1.8 per cent growth in 2024.

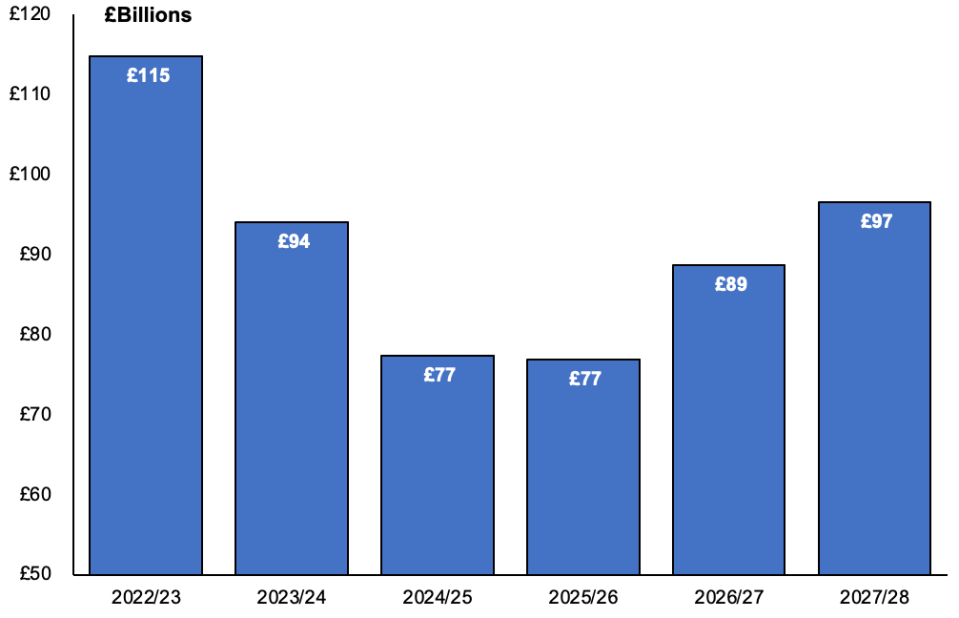

OBR thinks the UK’s debt interest bill will hit £94bn this year

“[The OBR] is too upbeat about the economy’s medium-term economic outlook… despite the more robust near-term outlook, we think that GDP in five years’ time will be about 1.5 per cent lower than the OBR expects,” he said.

That would reduce the government’s tax revenues, which are in part a function of spending in the economy.

However, any fiscal headroom Hunt does have left over will be used to table tax cuts to cozy up to voters.

In response, the Bank of England would keep interest rates elevated to tamp down on demand and keep inflation in check, Tombs said.

“The [monetary policy committee] will have to take account of the discretionary loosening of the fiscal plans when mulling how quickly to cut Bank Rate next year,” he said.

“So while we expect the MPC to raise Bank Rate only once more, to 4.50 per cent, this year, we expect the committee to reduce it by only 100 basis points in 2024, leaving it at a still above-neutral 3.50 per cent rate at the end of next year.”

Bank Governor Andrew Bailey and co have already lifted interest rates eleven times in a row. Those moves alongside rising prices have engineered a squeeze on living standards, which the Bank’s chief economist Huw Pill yesterday said is something Britons “need to accept”.

The OBR cautioned in its latest forecasts “against viewing interest rate movements in isolation”.