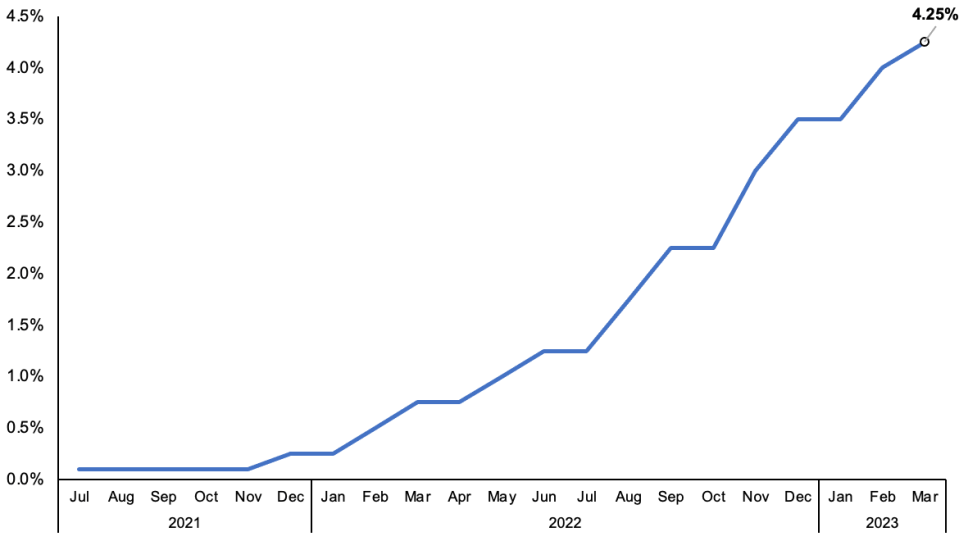

Bank of England hikes interest rates for eleventh time in a row to post financial crisis high of 4.25 per cent

The Bank of England today hiked interest rates for the eleventh time in a row to a post-financial crisis of 4.25 per cent as it continues to lead the fight against the worst UK inflation crisis in four decades.

Governor Andrew Bailey and his team of rate setters bumped borrowing costs 25 basis points higher, a climb down from a series of outsized rises of at least 50 points.

London’s FTSE 100 slipped nearly one per cent on the news, while the pound strengthened around 0.5 per cent against the US dollar.

The move signals the Bank is moving in lock step with the US Federal Reserve and European Central Bank (ECB) in prioritising taming price pressures instead of easing strain on the global banking system that has laid waste to Credit Suisse and Silicon Valley Bank.

Bank officials moved to calm investor concerns about the UK banking system being dragged into the recent turmoil in the sector.

“The UK banking system maintains robust capital and strong liquidity positions, and is well placed to continue supporting the economy in a wide range of economic scenarios, including in a period of higher interest rates,” they said.

Rates have taken off over past year or so…

In a boost to Chancellor Jeremy Hunt, initial estimates by the Bank calculate the UK economy will grow 0.3 per cent faster over the coming years compared to their February forecasts as a result of measures taken in last week’s spring budget.

“GDP is still likely to have been broadly flat around the turn of the year, but is now expected to increase slightly in the second quarter, compared with the 0.4 per cent decline anticipated,” they added, signalling the Bank agrees with the Office for Budget Responsibility that the country may avoid a recession.

“With rising prices strangling growth and eroding family budgets, the sooner we grip inflation the better for everyone,” the Chancellor said in response to today’s move.

Rate setters voted 7-2 in favour, including Bailey, to kick rates higher, with MPC members Swati Dhingra and Silvana Tenreyro repeating their vote from the last meeting to leave rates unchanged.

Today’s move now takes Bailey and co’s cumulative tightening process to over 400 basis points since December 2021, placing it among the most aggressive rate rise campaigns in history.

The Bank has been piling misery on households and businesses in a bid to chill spending to reduce inflation.

Higher rates, in theory, slim demand by incentivising individuals to save instead of spend and deterring businesses from borrowing to invest.

They also put downward pressure on house prices by increasing mortgage rates, which tends to knock consumer confidence.

… to tame scorching inflation

The inflation leap means Britain now clearly has the highest inflation rate in the rich world.

City experts had expected February’s rate to have slipped back into the single digits, while the Bank reckoned it would slim to 10.2 per cent.

Analysts now reckon central banks are nearing or are at the end of their tightening cycles, judging that more increases will do little to hit inflation and could even tip their respective economies into unnecessary recessions.

“The recent tensions in the banking system and the lingering risk of a recession should keep a lid on [UK] interest rates going forward,” Yael Selfin, chief economist at KPMG UK, said.

If wage demands continue to whittle down and firms keep slowing price rises, then James Smith, developed markets economist at Dutch bank ING, thinks “a pause in May is likely”.

Still market don’t think the Bank will cut rates until early next year.

Fed officials last night voted to raise rates for the ninth time in a row, by 25 basis points, but signalled they only expect to sign off one more increase this year.

ECB president Christine Lagarde and her team are likely to opt for one more 50 basis point this year.