Bank of England hikes interest rates for twelfth time in a row and warns of ‘significant’ inflation risk

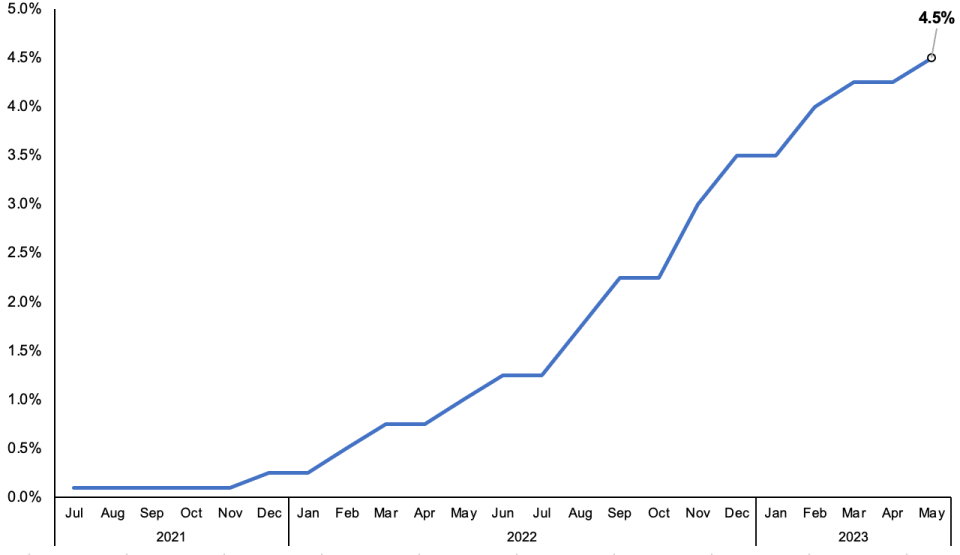

The Bank of England today hiked interest for the twelfth time in a row and to their highest level since October 2008, but warned inflation will stay higher for longer than it previously thought.

The monetary policy committee (MPC) – the nine-member group tasked with setting interest rates in the UK – voted 7-2 in favour of raising borrowing costs 25 basis points to 4.5 per cent.

The pound weakened about 0.2 per cent against the US dollar, while the FTSE 100 shed 0.29 per cent on the news.

City analysts expected the move, though there had been in the run up to the meeting division over whether today would be the Bank’s final rate rise.

Markets think more rate rises are coming, though economists think today’s move was the Bank’s last.

“Interest rates are now at their peak,” Paul Dales, chief UK economist at consultancy Capital Economics, said.

“The base case remains for no further increases in Bank Rate,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Borrowing costs aren’t forecast to start falling until around the middle of next year.

“We suspect that lingering inflation concerns will mean that the holding phase of the cycle will last until the first half of 2024,” Dales added.

Bank officials baked in more inflation compared to their last set of comprehensive forecasts in February, primarily driven by food prices rising sharply.

“Almost all of the upside news in CPI inflation data since the February Report has been accounted for by developments in food and other goods,” the central bank said in its monetary policy report.

According to the Office for National Statistics, food prices rose around 19 per cent over the last year, the fastest increase in about 40 years.

UK interest rates have reached their highest level since 2008

If inflationary pressures stick around, “further tightening in monetary policy would be required,” the Bank said, a commitment it backed at its last meeting in March.

Governor Andrew Bailey in a press conference after the rate decision was announced said the Bank needs to “stay the course” to get bring inflation down.

Bank officials judged that the risk of inflation staying above their two per cent target – where it has been since the summer of 2021 – remain “skewed significantly to the upside,” indicating further rate increases could be on the cards.

Since December 2021, Bank Governor Andrew Bailey and co have lifted borrowing costs 440 basis points, the most aggressive rate rise cycle since the 1980s.

Those rises have yet to make a meaningful dent into inflation, which is still running at 10.1 per cent, topping the Bank and Office for Budget Responsibility’s projections.

April numbers released later this month are expected by the Bank to show inflation trimmed sharply to 8.4 per cent.

Only around a third of those effects have filtered through to the UK economy, primarily because of the huge shift to fixed-term mortgages from floating rates after the 2008 financial crisis.

Households and businesses will feel more of the effects of the Bank’s previous rate increases “in the coming quarters,” Bailey added.

The MPC upgraded GPD growth over its forecasts period by a shade more than two percentage points, the greatest lift since it was created in 1997 when the Bank of England was made independent.

The UK economy is now tipped to broadly flatline this year and start growing in the final six months, leading the Bank to raise its 2023 GDP projections 0.75 percentage points compared to February.

Output is tipped to broadly flatline this year and expand 0.75 per cent next year, still weak, but a sharp turnaround from the Bank projecting 15 straight months of GDP contraction in November, which would’ve been the longest recession in a century.

“The improved outlook reflects stronger global growth, lower energy prices, the fiscal support in the Spring Budget, and the possibility that a tight labour market leads to lower precautionary saving by households,” the Bank said.

An extension of the energy price cap to July in the March budget shielding family finances, alongside other goodies launched by Chancellor Jeremy Hunt, improved the economic outlook by 0.5 percentage points.

Prime Minister Rishi Sunak is also tipped to meet his goal of halving inflation by the end of the year – just.

The rate of price increases will still be running at around five per cent come Christmas, far above the Bank’s two per cent target.

Governor Bailey backed the 25 points rise. Silvana Tenreyro and Swati Dhingra wanted to keep rates unchanged at 4.25 per cent, a position they’ve adopted for a couple meetings now.