Bank of England hikes interest rates by 50 points to five per cent after inflation shock

The Bank of England today reverted to steeper interest rate rises in a sign that embattled Governor Andrew Bailey and co have been spooked by much tougher than feared inflation.

Bailey and the rest of the monetary policy committee (MPC) – the nine-strong group who set official interest rates in Britain – backed a 50 basis point increase, hoisting rates up to five per cent, their highest level since September 2008.

It is the 13th time in a row the Bank has raised rates and larger than the expected 25 basis point jump.

Seven members of the MPC, including Bailey, backed the bumper increase. Two members, Swati Dhingra and Silvana Tenreyro, wanted to maintain borrowing costs at 4.5 per cent.

Markets now think the Bank will lift borrowing costs to a peak of just over six per cent, somewhere they have not been in 23 years, and keep them there until May 2024. A 50 basis point rise is also on the table at the MPC’s next meeting in August.

Bailey said the jumbo borrowing cost increase was needed to contain inflation otherwise “it could be worse later”.

Speaking to Sky News, he claimed the current pace of wage growth and firms’ appetite to beef up profit margins are “unsustainable” and must be reined in in order to curb the cost of living.

Pound sterling whipsawed on the news, strengthening, then weakening, before strengthening again against the US dollar. London’s FTSE 100 slid 0.8 per cent, while yields on UK debt jumped.

Core inflation – which removes volatile food and energy prices – leapt unexpectedly to 7.1 per cent from 6.8 per cent, while services inflation, which the Bank monitors closely for signs of underlying price pressures, climbed to 7.4 per cent. Wages have been pacing, though lagging inflation.

The MPC “is demonstrating its inflation fighting credentials as well as sucking more demand out of the economy,” Thomas Pugh, an economist at consultancy RSM, said.

Today’s decision is a return to the larger rate increases that the Bank used at the beginning of its tightening cycle.

Stronger than feared wage growth and firms being able to pass on higher costs via higher prices due to robust demand led the Bank into the aggressive pivot.

“The second-round effects in domestic price and wage developments generated by external cost shocks were likely to take longer to unwind than they had done to emerge,” the MPC said.

“The scale of the recent upside surprises in official estimates of wage growth and services CPI inflation suggested a 0.5 percentage point increase in interest rates was required,” they added.

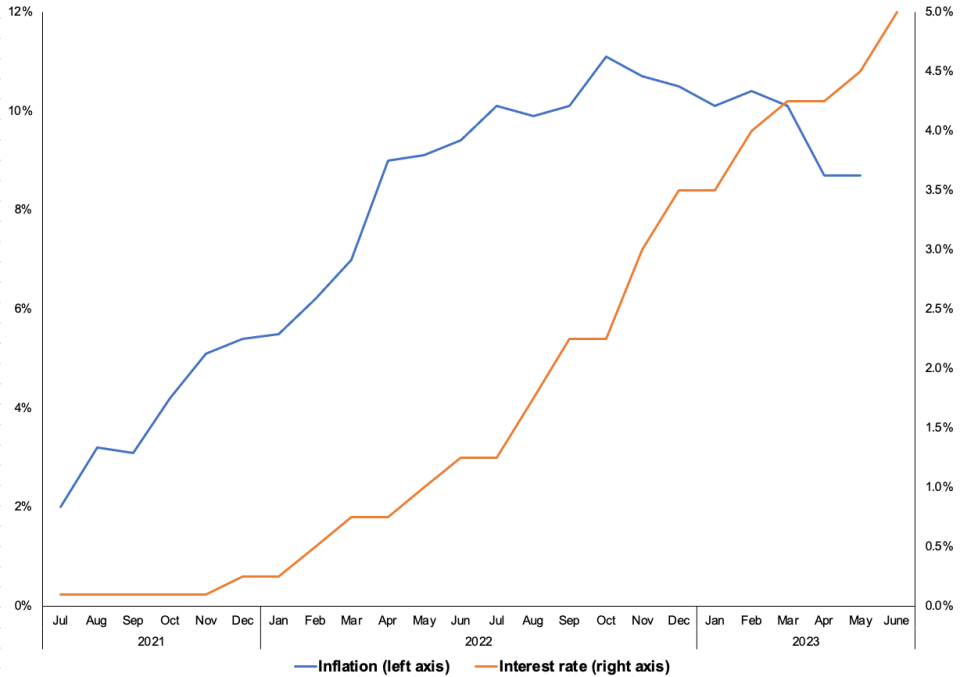

UK interest rates have risen sharply in response to rising prices

Analysts said the Bank’s ease with returning to larger increases signals more such hikes could come.

MPC officials displayed “little hesitation today to opt for a 50bp hike,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Bailey has been under intense fire for failing to get a grip on Britain’s inflation problem, which is the worst in the rich world. US and European inflation is four per cent and 6.1 per cent respectively.

Conservative MPs and former rate setters have slammed the Governor and the Bank’s forecasts for persistently undershooting inflation and not raising interest rates sooner.

“Inflation is expected to fall significantly further during the course of the year, in the main reflecting developments in energy prices,” the Bank said today.

Chancellor Jeremy Hunt said he and Prime Minister Rishi Sunak’s commitment to halve inflation by the end of the year to around five per cent is “watertight”.

The Bank was the first major central bank to lift borrowing costs in December 2021, although the steepness of hikes after that initial move trailed America’s central banking equivalent, the Federal Reserve, who has sent rates to a range of five per cent and 5.25 per cent.

Recession risks in the UK have reignited in recent weeks as markets have ratcheted up their peak rate expectations to more than six per cent.

Analysis from the economic think tanks the Resolution Foundation and Institute for Fiscal Studies has found around 1.5m homeowners will see a large chunk of their disposable income wiped out when they remortgage on much higher rates.

Financial data firm Moneyfacts calculates average rates on 2-year mortgages have topped six per cent, around double the level this time last year.

Economists reckon re-mortgagors will respond by trimming spending, choking economic growth and possibly fling the country into a slump.