Bank of England chief economist Pill admits we ‘underestimated’ inflation surge

The Bank of England did not understand inflation “well enough” and “underestimated” the strength of the 40-year high price surge, its chief economist admitted in a speech in the US today.

Huw Pill said with “the benefit of hindsight,” the central bank’s “own analysis” failed to foresee inflationary pressures magnified by global supply chain pressures after the pandemic.

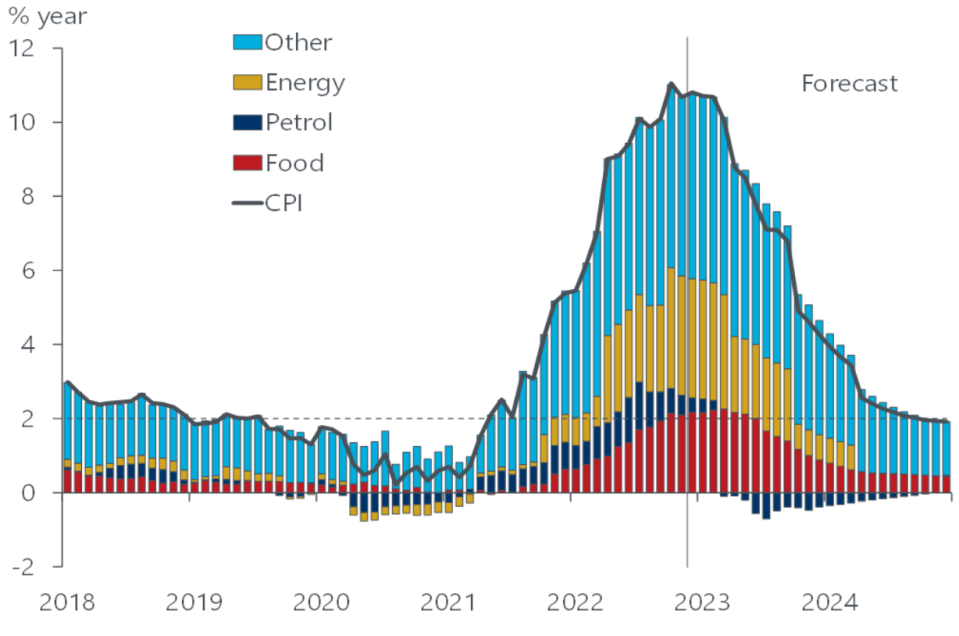

Inflation has run above the Bank’s two per cent since the summer of 2021.

The initial burst was sparked by trade flows struggling to keep pace with a sudden jump in global spending after governments rolled back restrictions on daily life to tame Covid-19 infections.

It was those early signs of inflationary pressures that Pill admitted the Bank overlooked. In February, when inflation was beginning to rise, the monetary authority forecast the cost of living would peak around seven per cent.

Since then, charged by Russia’s invasion of Ukraine jolting international energy markets, inflation surged to a peak of more than 11 per cent in 2022.

Pill and his boss, Andrew Bailey, have backed nine successive interest rate increases since December 2021, including a 75 basis point rise, the biggest move since the 1980s.

Inflation is on course to fall sharply

Rates are now 3.5 per cent, the highest since 2008. Pill signalled he could back another 50 point rise at the Bank’s next meeting on 2 February.

A shallower workforce caused by more 500,000 dropping out of the jobs market since the pandemic, coupled with the UK paying much higher prices to import energy “creates the potential for inflation to prove more persistent,” Pill, a former Goldman Sachs banker, said.

Rate setters are worried companies have accrued too much pricing power, meaning they can pass on higher costs to consumers and still sell products due to demand running high in the UK economy.

Unemployment is running at a multi-decade low and wages are rising rapidly, although they trailed inflation for most of last year.

Pill said he was worried about workers inflation chasing pay rises sparking a round of price increases from businesses, a dynamic known in economics as a “wage/price spiral”.

Prime minister Rishi Sunak said over the weekend inflation will halve this year due to plans put in place by the government.

Achieving low and stable inflation is the Bank’s remit. “It is the job of monetary policy to return inflation to target,” Pill pointed out.