Bank of England chief economist Huw Pill admits forecasts have struggled to explain inflation shock

Any central banker would have struggled to accurately forecast the impact of the series of shocks that have hit the UK economy, the Bank of England’s chief economist claimed today.

Huw Pill, a former Goldman Sachs banker, in response to a letter from the Treasury select committee today hit back at critics who have slammed the Bank for persistently getting its inflation forecasts wrong.

“Any single model would have struggled to capture the impact and propagation of the economic shocks we [have] seen in recent years,” Pill said, referring to the Covid-19 crisis and Russia’s invasion of Ukraine.

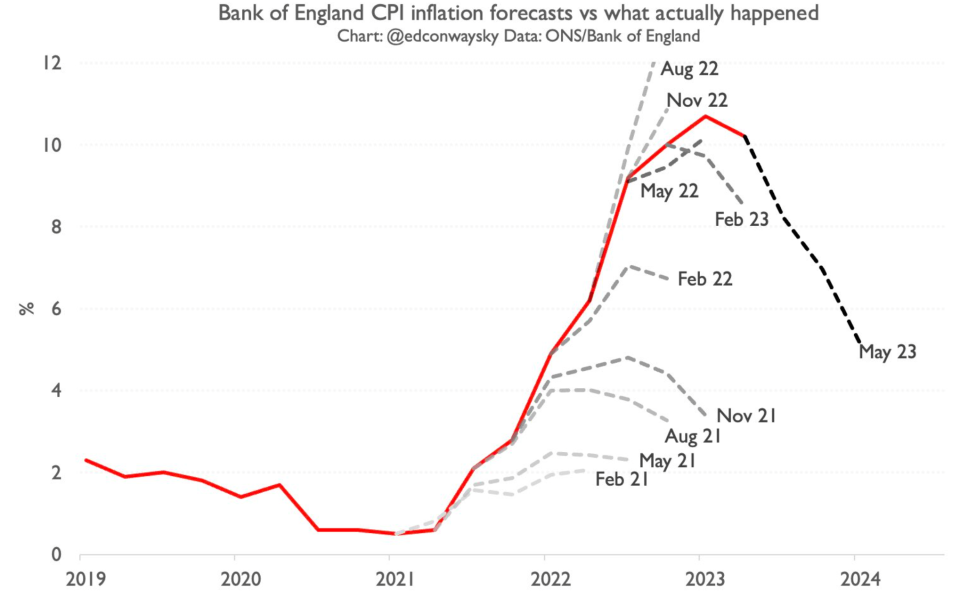

For around a year and a half, monetary policy committee (MPC) officials have had to revise up their inflation projections.

That overshoot has been mainly driven by food prices accelerating more than 18 per cent, something the Bank has recognised it did not see coming.

That has led to sharp scrutiny of how the Bank generates its quarterly economic forecasts. Some have questioned how the MPC can set interest rates effectively if the group is unable to get a grasp of inflation, growth and unemployment.

Pill said: “The greatest weakness of the current forecasting framework is the difficulty it faces in explaining the greater-than-expected persistence in UK inflation following the large – one could say unprecedented – external inflationary shock following the invasion of Ukraine.”

Models are simplified scenarios of the real world that experts use to understand how an economy is performing. Because they use a set of assumptions that typically do not reflect lived experiences, they are rarely 100 per cent correct.

Instead, they are designed “to develop a narrative for the evolution of the economy and the outlook for inflation that underpins monetary policy decisions,” Pill said.

“They are a means to shape, steer and anchor private sector inflation expectations, in financial markets and of households and firms, so as to influence behaviour in a way that supports the MPC’s achievement of its remit,” he added.

Pill’s thoughts were set out in response to a letter from MPs on the cross-bench Treasury select committee demanding the Bank explain why its forecasts have been wide of the mark.

The Bank is currently undertaking a root and branch approach to its present forecasting methods to understand why it has been so wrong on inflation, which has been above its two per cent target since July 2021.