Bank of England aggressive rate hikes send chill through UK construction economy

The Bank of England’s ten successive interest rate rises have sent a chill through the UK’s construction economy, a closely watched survey out today shows.

Potential home buyers are shunning purchases due to mortgage rates flying higher, prompting house builders to rein in spending.

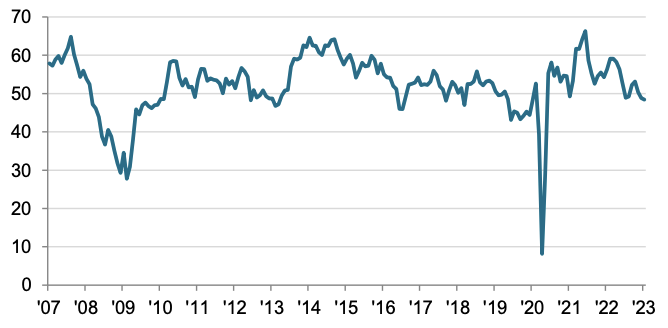

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) latest purchasing managers’ index (PMI) for the construction industry dropped to 48.4 points last month, down from 48.8 points in the previous month and below analysts’ predictions.

Output among Britain’s house builders collapsed to 44.8 points, plunging the sector deep into the PMI’s contraction territory of anything below 50 points.

“Construction output reportedly fell in January at the fastest rate since May 2020, as the impact of the sharp rise in borrowing costs and jump in economic uncertainty in the second half of last year fed through to building activity,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Tombs added that the end of the government’s Help to Buy loan scheme in March, which gives first time buyers subsidised finance if they buy a newly built house, will accelerate the construction economy’s downturn.

Critics argue the scheme has jacked up house prices, pricing a big chunk of first time buyers out of homeownership.

Would-be buyers are also being squeezed out of the housing market due to lenders passing on the Bank’s aggressive rate hike cycle.

Construction activity has slipped below the growth threshold

According to data provider Moneyfacts, rates on average 2-year and 5-year mortgages have more than doubled over the past year, up to around 5.5 per cent.

Bank governor Andrew Bailey and co have yanked rates from 0.1 per cent in December 2021 to four per cent this year, the highest level in 15 years and the quickest tightening campaign since the 1980s.

Inflation raced to a 40 year high last year, forcing the Bank to act.

Today’s PMI is the latest indication that the UK is poised to tip into recession soon. Both the services and manufacturing surveys are in contractionary territory.

Last week, the Bank slashed its recession forecast to 15 months from 18 months and said it would knock just under one per cent from GDP instead of nearly three per cent, mainly due to inflation falling quicker than expected.

Figures out from the Office for National Statistics on Friday are expected by investors to reveal the economy shrank 0.3 per cent in December, caused by colder weather gumming up activity.

That would be enough for the country to avoid a technical recession – two back-to-back quarters of negative growth – at the end of last year.