Bank of England fines RBS over payments crash

NEGLECTED IT systems could put the safety and soundness of RBS at risk, the Bank of England warned yesterday as it teamed up with the City watchdog to fine the bank £56m.

The regulators were investigating a serious payments system crash, which locked millions of customers out of their accounts in mid-2012.

It is a key moment for the regulatory system as it is the first fine levied by the Bank of England.

Most recent fines have been levied by the Financial Conduct Authority (FCA) for bad behaviour or for harming customers.

By contrast, the Bank of England’s Prudential Regulation Authority (PRA) gets involved when there are risks to the wider financial system.

“The severe disruption experienced by RBS, NatWest and Ulster Bank in June and July 2012 revealed a very poor legacy of IT resilience and inadequate management of IT risks,” said PRA boss Andrew Bailey.

“It is crucial that RBS, NatWest and Ulster Bank fix the underlying problems that have been identified to avoid threatening the safety and soundness of the banks.”

The PRA issued a £14m fine, and the FCA charged RBS £50m.

“When I first arrived at RBS in 2013, my number one priority was to ensure that any investment in IT was targeted in the right areas,” said the bank’s chief administrative officer Simon McNamara. “As a result, by the end of 2015 we will have invested an additional £750m in enhancing the security and resilience of our IT systems.”

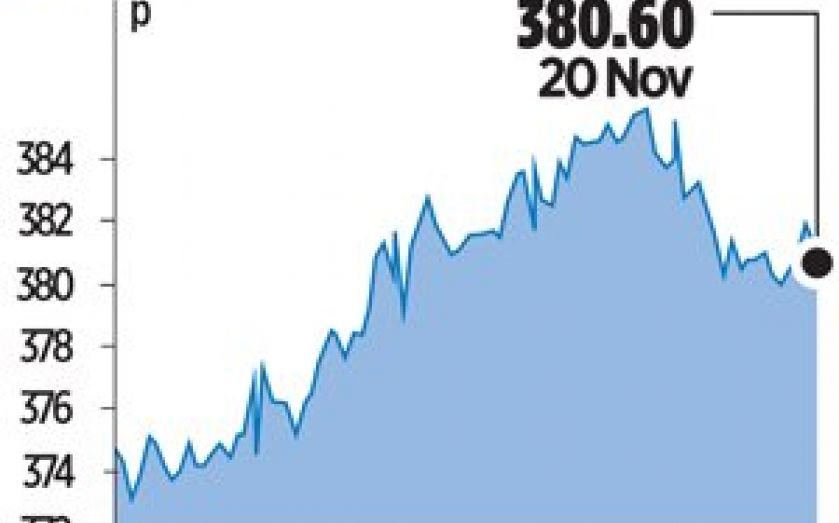

RBS’ shares fell 0.83 per cent to close at 380.60p.