Bank cutbacks leave dent in Icap’s profits

POOR trading conditions hit profits again at Icap in 2013, the interdealer broker reported yesterday.

Banks have cut back activity in areas such as bond trading, leaving the firm with lower volumes.

Trading profits fell four per cent to £272m in the year, as revenues dipped by five per cent to £1.4bn.

The broker blamed regulations for dragging down banks’ fixed income and currencies volumes, and warned those customers “do not foresee any material near-term recovery.”

Icap also said low interest rates and a lack of exchange rate volatility had reduced trading activity by clients, hitting revenues.

The firm was also hit by a £55m fine for involvement of some staff in helping bank traders try to fiddle Libor.

Revenues in the firm’s electronic markets division fell one per cent to £265m, pushing down trading operating profits by five per cent to £107m.

However, profits increased in its post-trade risk and information arm, with total revenues up three per cent to £212m and trading operating profits up seven per cent to £96m.

Chief executive Michael Spencer argued there is some cause for hope.

“I believe there are reasons to be optimistic. Icap, with its diverse portfolio of businesses, is uniquely positioned to provide the full range of pre-trade, execution and post-trade services,” he said.

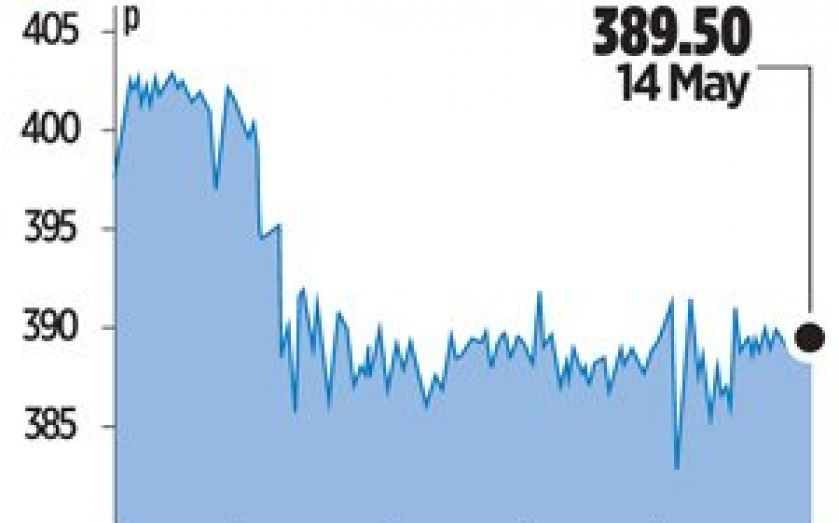

Icap’s shares dipped 0.38 per cent.