Ban fossil fuel alternatives to meet green hydrogen goals, says investment boss

The government will need to speed up the phasing out of grey hydrogen if it wants to meet its clean energy targets in the sector, the boss of a leading hydrogen fund has warned.

Richard Hulf, managing partner of London-listed investment group Hydrogen One, told City A.M. that the government could not solely rely on consumer demand to drive hydrogen generation towards the 10GW target outlined in its energy security strategy.

He argued that banning grey hydrogen – produced by fossil fuels without carbon capture – would make a “big difference” for boosting investor sentiment towards zero carbon alternatives such as green hydrogen, made through electrolysis in water molecules powered by renewables.

“The government has been very good at that sort of thing in the past, they just legislate against things that are polluting to stop petrol and diesel just killing people,” he said, referring to the upcoming ban on sales of new petrol and diesel cars in 2030.

The government is opting for a twin track approach of green and blue (fossil fuel based but with carbon capture) to reach its energy targets, but has consistently ruled out joining the subsidies race with US and European Union to meet its climate and supply security goals.

As it stands, UK generation from green hydrogen remains well below 1GW.

| Energy Source | Generation | Target | Date |

| Solar | 17GW | 70GW | 2035 |

| Offshore Wind | 15GW | 50GW | 2030 |

| Nuclear | 7GW | 24GW | 2050 |

| Hydrogen | <1GW | 10GW | 2030 |

Hulf argued it should instead consider adopting mechanisms for attracting hydrogen funding in line with the government’s offshore wind auctions.

This is where companies compete to offer the lowest generation prices in exchange for guarantees of income in case of price volatility, while accepting a cap in the case of a market boom – known as the ‘contracts for difference’ scheme which also operates in solar and carbon capture.

The fifth allocation round for offshore wind projects is currently underway, with the previous four driving down generation prices.

He said: “When the government launched wind in the UK was offering a price mechanism, where the government was to backstop for volatility for pricing for new wind-based electricity. They could do the same thing with hydrogen pricing to help smooth the introduction of a proper market in hydrogen.”

Hulf considers hydrogen’s role to be “complementary” to more mainstream renewables like solar and wind.

He sees opportunities in green steel, backup systems for computers, and heavy vehicles such as trucks – but warned that investment in the energy source had to be selective about where it can make the most impact.

“We definitely see a singular role for hydrogen in in converting HGV trucks, trains and planes, but we’re under no illusions that this there’s no competition for for batteries on small vehicles,” he said.

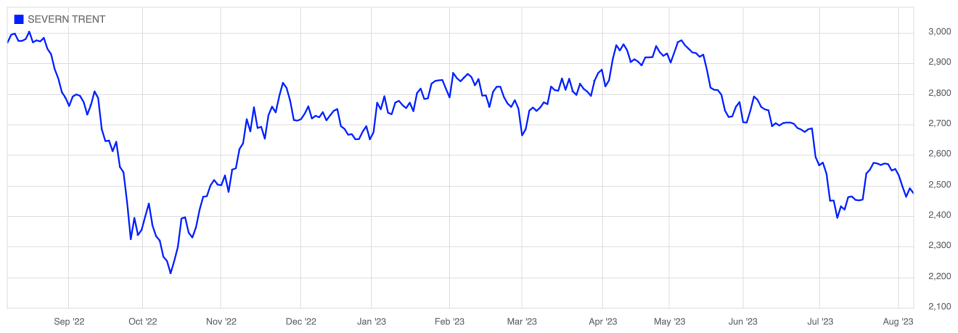

Hydrogen One’s shares rise after rocky period

Hulf’s comments follow the latest trading update from the company, which has posted robust second quarter results on the London Stock Exchange – including a 170 per cent year-on-year revenue growth to £52m.

This powered shares in Hydrogen One up 10.8 per cent yesterday – a welcome boost after a rocky share price journey in recent months, with the company trading at an average 13.7 per cent discount for the 12 months up to July this year.

Hydrogen One was set set up two years ago and has made 10 investments in hydrogen companies in the UK and Europe from energy producers to equipment and small part manufacturers – spending around £110m in the process.

Three companies it supports are producers, utilising electrolysers on site to produce green hydrogen.

The fund has also backed seven other companies that manufacture engineered components such as electrolysers, fuel cells, pipes and are involved in the transportation of hydrogen

The company told City A.M. earlier this year it was weighing up deals in the US – which it is still considering.

The government has been approached for comment.