BAE slides as it warns on profit for a third year

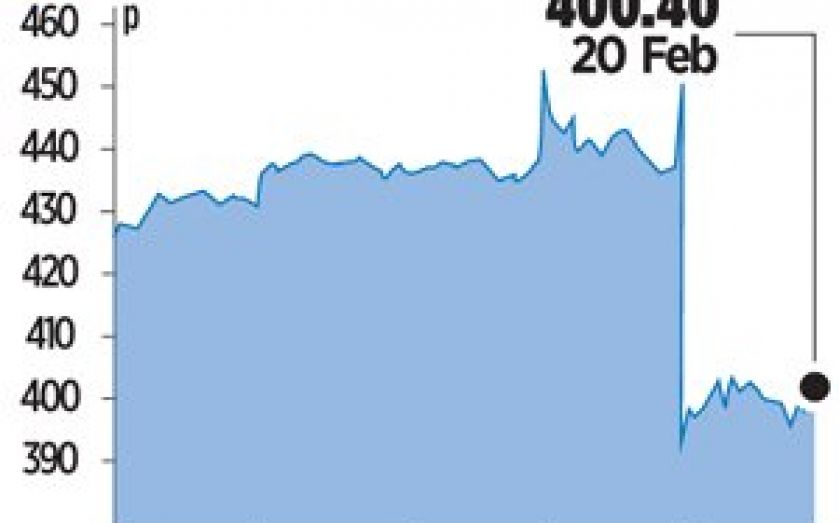

SHARES in BAE Systems plummeted yesterday, after the FTSE 100-listed defence giant warned that earnings would be lower this year due to US budget cuts and delays to finalising a Saudi jets deal.

“Following last year’s non-recurring benefit from the Salam price escalation settlement, together with continuing US budget pressures, the group’s reported earnings per share is expected to reduce by approximately five per cent to 10 per cent compared to 2013,” BAE said in a statement.

The company had to lower its full-year earnings guidance for the previous two years after it failed to agree on a price for the 72 Typhoon aircraft it said it would sell to Saudi Arabia back in 2007. The deal at the time was worth around £4.5bn.

It finally agreed on pricing on Wednesday, meaning the deal will be factored into 2014’s results.

Yesterday’s profit warning came as the company reported a three per cent rise in underlying core earnings to £1.9bn in 2013, while underlying earnings per share increased by nine per cent to 42p.

“We have started 2014 with good momentum with a settlement on Salam pricing, US budgets in place and a well-defined UK maritime sector plan,” said chief executive Ian King.

“Budget pressures in some of the group’s larger markets are expected to prevail but BAE Systems has a broad-based portfolio. Our strong order backlog and robust balance sheet provide a solid basis for growth over the medium term.”

Shares closed 8.3 per cent lower.