Babcock boss plays down prospect of future takeover

The boss of Babcock has played down the prospect of a takeover amid the company’s turnaround plan.

David Lockwood, chief executive of the British defence firm, told The Mail on Sunday that an upcoming sale was “incredibly unlikely”.

The defence boss was instead focused on doing the “interesting bit” of managing the company’s business strategy after cutting costs and scaling back operations.

He also argued that acquisitions in the defence sector were challenging due to the government scrutiny on each deal.

“I think it’s incredibly unlikely. I hope it’s incredibly unlikely for a few reasons. For one, there aren’t that many people in the nuclear space. Anyone wanting to enter that arena would have to clear a UK government hurdle, which, given that we maintain the UK’s nuclear fleet is a, very high hurdle,” he said.

Lockwood was at the centre biggest takeover rows when he sold the defence firm Cobham to US private equity group Advent in a £4bn deal – which eventually led to its controversial break up.

However, the boss is committed to turning around Babcock – after being brought in three years ago after the FTSE 250 firm issued multiple profit warnings.

In July 2021, Babcock announced write-offs and charges to the tune of £2bn, and job cuts of up to 1,000 staff – after a review of the company’s balance sheet.

Lockwood’s plans have included offloading a large segment of its rescue helicopter business and parts of its civil training division.

He has now confirmed the ‘stabilisation’ phase of his overhaul is complete.

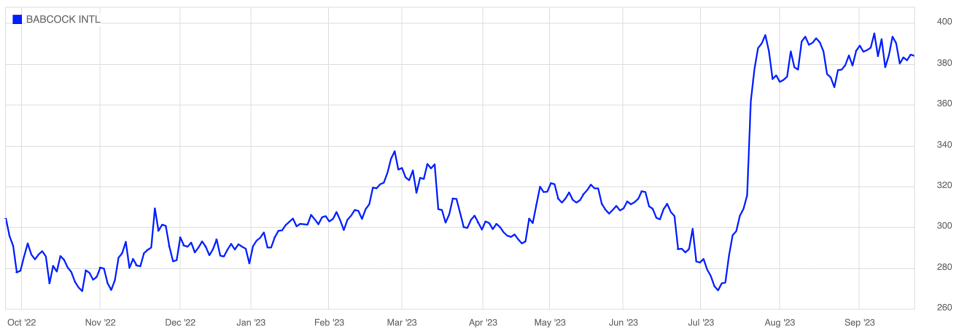

The measures have also won the backing of City investors, with the company’s share price enjoying a 30-plus per cent boost this year.

Babcock’s annual results released last month showed a rise in sales but a decline in profits from £182m to just £6m.

This followed a £100m hit from a major contract to build Type 31 frigates, with the company still locked in talks over the deal with the Ministry of Defence.

Babcock begins trading 0.16 per cent down the London Stock Exchange on Monday morning, at 384p per share.