Aviva ensures FTSE stays near its record high – London Report

ARALLY by insurance giant Aviva and same sector shares pushed the FTSE100 closer to record highs again yesterday.

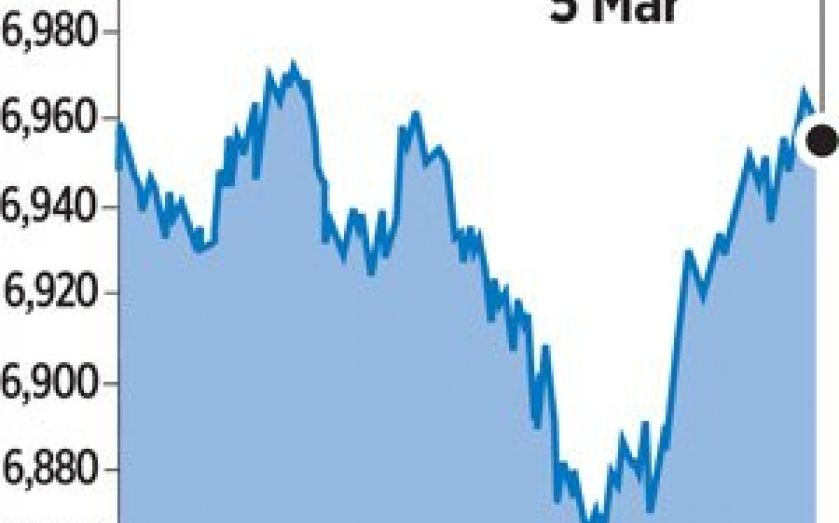

The blue-chip FTSE 100 index closed up 0.6 per cent at 6,961.14 points, near the 6,974.26 record it set this month.

Traders said that European equities were further supported by confirmation that the European Central Bank (ECB) will start a bond-buying programme – aimed at boosting the region’s economy – this month, while the Bank of England also kept interest rates at record lows.

“I think that a new record of 7,000 points for the FTSE is just around the corner,” Berkeley Future’ associate director, Richard Griffiths, said.

Aviva rose 7.1 per cent, to be among the top gainers in the FTSE 100, after reporting higher profits.

“The results are both broadly pleasing and in stark contrast to the travails of recent years, most notably the financial crisis and subsequent dividend cut in 2013,” Hargreaves Lansdown stockbrokers head of equities, Richard Hunter, said of Aviva.

Sector peer Friends Life also advanced 7.1 per cent after reporting a 38-per cent rise in pre-tax profit.

Shares in broadcaster ITV rose 2.8 per cent after HSBC, Goldman Sachs, Berenberg, JPMorgan and Nomura all raised their price targets for the stock, a day after it announced the return of cash to shareholders. Goldman also added ITV to its “conviction list”.

However, miners faced some selling pressure after China, the world’s biggest metals consumer, lowered its economic growth target for 2015 to about seven per cent, below 2014’s 7.5 per cent goal. The FTSE 350 Mining Index underperformed the broader market rally to close flat.

British bank HSBC also fell 2.7 per cent as it went “ex-dividend”, meaning the stock was trading without the attraction of its latest payout.

Meanwhile, sterling rose to its strongest since late 2007 against the euro yesterday, bolstered by signs that the ECB money-printing plans far into next year or longer to restore growth to the Eurozone.

In a volatile few minutes during ECB president Mario Draghi’s post-meeting news conference, sterling fell then recovered to hit a more than seven-year high of 72.23p per euro.

That extends a run of losses for the single currency that analysts believe should continue against both the dollar and sterling, given prospects of U.S. and UK interest rates rising in the next year.