Avago share price soars as $37bn Broadcom takeover is confirmed

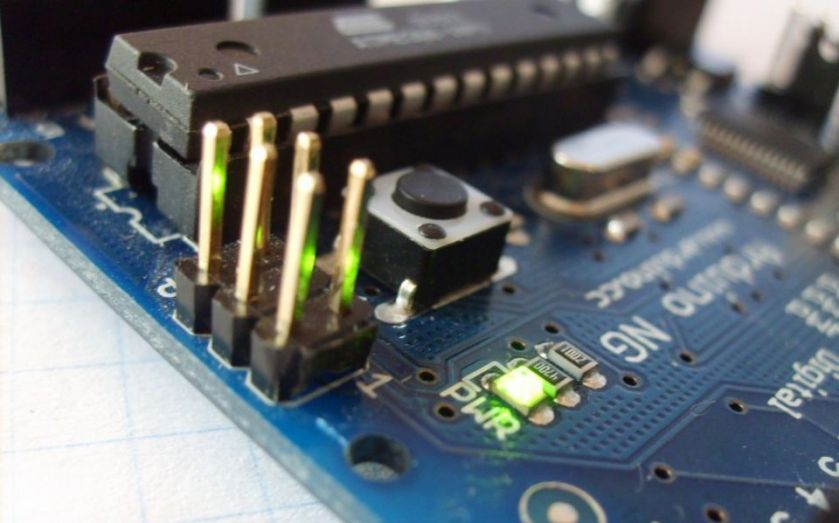

Avago Technologies has sealed a $37bn acquisition of fellow semiconductor company Broadcom to create an industry giant with estimated annual revenues of $15bn.

Singapore-based Avago is paying $17bn in cash and $20bn worth of its own shares (making it the largest ever merger of chipmakers) to fund the deal for the US firm which builds the mobile communications chips used by Apple and Samsung in their mobile devices.

After details of the deal were reported last night, Broadcom's share price rocketed 21.8 per cent, while stock in Avago made more modest gains of 7.76 per cent, both on the Nasdaq. In pre-market trading, Avago's stock is making similar gains, while there is little movement in Broadcom shares following yesterday's flurry.

Read more: An interview with Britain's chief chipmaker

In a statement chief executive Hock Tan commented on the deal:

The combination of Avago and Broadcom creates a global diversified leader in wired and wireless communication semiconductors. Avago has established a strong track record of successfully integrating companies onto its platform.

Together with Broadcom, we intend to bring the combined company to a level of profitability consistent with Avago's long-term target model.

Avago's purchase of Broadcom follows a year in which it bought three other chipmakers; LSI Corp for $6.6bn, PLX Technology for roughly $300m and Emulex Corp for around $600m in a bid to expand its operations in data communications and the telecoms markets.

Last year Avago, a former unit of Hewlett-Packard, reported $4.3bn in sales.