Autonomy avoids gloom thanks to banking deals

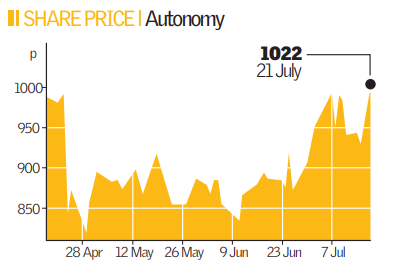

Software firm Autonomy yesterday reported expectation-busting figures for its second quarter and was bullish about the second half of the year, sending its shares soaring to an eight-month high.

The Cambridge-based company, which develops software for tracking email and phone conversations, said pre-tax profits rose by 85 per cent to £25.4m, exceeding analysts’ expectations of about £20.5m. Revenues in the quarter were up 72 per cent at £62.83m.

Three “mega deals” with banks, including a £65m contract with a Wall Street institution, helped to boost revenues, although much of the income from these deals will be included in Autonomy’s next results.

According to chief executive Mike Lynch, the subprime mortgage crisis will lead to more large contracts with US banks, which are keen to track communications to protect against litigation.

Lynch said that the company’s lack of consumer exposure meant that it wasn’t feeling the impact of a tough economic climate. Strong cashflow had also bolstered the group’s cash position to £39.5m at the end of June, compared to £25m at the end of the first quarter.

According to Lynch, returning cash to shareholders, either through a stock buyback programme or a dividend, is now a distinct possibility, although a bank loan of £20m will need to be wiped out first.

“Key metrics remain very strong, supporting our view that underlying momentum in the business is stronger than reflected in the numbers and the capacity for additional upgrades exist as recent large deal closures have not hit the balance sheet,” said Goldman Sachs analyst Mohammed Moawalla.