Aston Martin shares climb as HSBC says investors should buy its stock

Aston Martin’s share price climbed today after HSBC advised investors to buy the troubled luxury car maker’s stock despite its latest loss.

The manufacturers of James Bond’s favourite ride swung to a £13.5m loss in its latest quarter as Brexit fears dampened demand in the UK and EMEA.

Read more: Aston Martin is hoping next year’s James Bond movie will boost its share price

But HSBC gave the company’s stock a ‘Buy’ rating. The firm has said 2020’s Bond movie, No Time to Die, should give sales a lift in the key market of China.

Aston Martin’s share price rose 3.9 per cent to 485.3p in early trading, after sharp rises at the end of last week despite an underwhelming set of results.

But Markets.com’s chief market analyst, Neil Wilson, expressed scepticism of HSBC’s new rating.

“On a purely valuation basis there is an argument, but debt levels are a worry,” he said.

Aston Martin is sitting on an £800m debt pile, up a third from last December’s £560m. Meanwhile third quarter revenue slumped 11 per cent, while car production sank 16 per cent.

The firm has seen its share price plunge 75 per cent since its October 2018 debut of 1,900p to today’s 485.3p value.

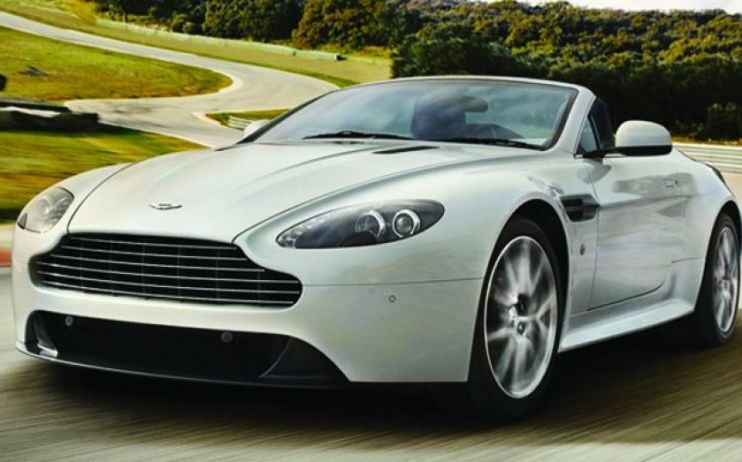

Last week it warned that demand for its least pricey model, the Aston Martin Vantage, remains below its original targets.

Read more: Aston Martin swings to £13.5m loss as demand starts to dry up

It is now pinning its hopes on its first SUV model, the DBX, as part of a plan to launch seven cars in just seven years.

Meanwhile, April’s Bond movie release will feature four Aston Martins – the FB5, the V8 Saloon, the new DBS Superleggera and the Valhalla.