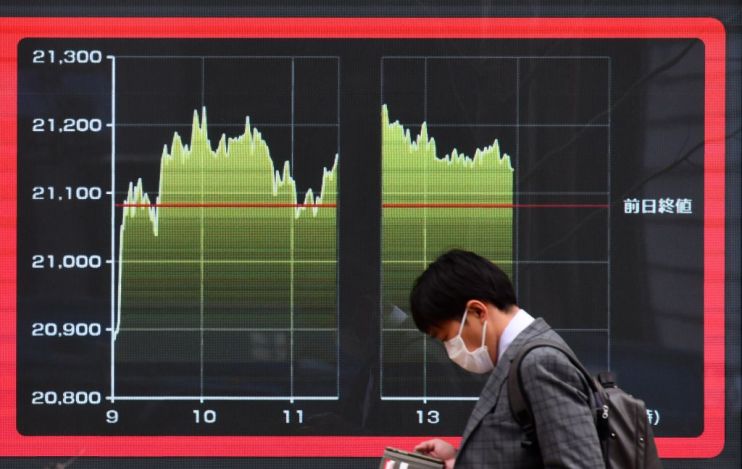

Asian stocks mixed after Fed rate cut fails to lift Wall Street

Asian stocks posted a mixed day of trading overnight after Wall Street dropped in dramatic fashion despite an interest rate cut intended to give the economy a break from the coronavirus fallout.

Japan’s Nikkei eked out a 0.08 per cent rise today but Hong Kong’s Hang Seng index slipped 0.12 per cent over the course of the day. Asian stocks lagged despite better than expected GDP growth in Australia over the fourt quarter.

That followed gains felt among Europe’s biggest stocks: the Euro Stoxx 50 climbed one per cent while the FTSE 100 ended trading almost a percentage higher.

But economists said Wall Street’s fall despite the Federal Reserve’s 50-basis point interest rate (0.5 percentage point) showed central bank action may not live up to trader expectation, as the coronavirus crisis rolls on.

Sign up to City A.M.’s Midday Update newsletter, delivered to your inbox every lunchtime

“It appears that the move rather frustrated investors who were expecting a more creative, or impactful action than a simple rate cut,” Ipek Ozkardeskaya, senior analyst at Swissquote Bank, said.

Traders doubted the Fed’s rate cut would do enough to mitigate global supply chain disruption as a result of the coronavirus. Covid-19’s escalating number of cases has forced airlines to cancel flights to affected regions. Both travel restrictions and muted consumer demand as a result of the crisis have driven the decision.

“We have a real issue here,” Ozkardeskaya added. “Investors are expecting central bankers to become the heroes that they are not meant to be.”

The Fed’s action yesterday is the first such move to slash rates it has taken since 2008 at the height of the financial crisis.

Peel Hunt pointed out the US had largely priced the rate cut in after rises earlier this week.

“The US market reaction to the Fed move was initially confused and ultimately negative,” Peel hunt analyst Ian Williams added.

The Fed rate cut came after the G7 said it was “ready to act” to help the world economy in the face of the coronavirus threat.

“As it so closely followed the G7 communique, it may be followed by other central banks providing stimulus, although they have less scope to cut rates than the Fed,” Williams said. “More creative thinking will be required.”

“Monetary policy cannot fix this problem but fiscal policy takes much longer.”