As Russia’s war in Ukraine rages on, venture investors are looking to cash in on ‘defence tech’

Russia’s invasion of Ukraine brought a sharp close to a decade-long venture capital funding frenzy last year, as soaring inflation, rapid rate hikes and tumbling valuations caused investors to hurriedly tuck away their cheque books.

Total venture capital investment globally plummeted some 32 per cent to $483bn in 2022 after reaching record levels the previous year, according to Dealroom data.

But while the global picture may have been bleak, one sector has proved a hit with investors.

The amount of venture capital pumped into defence technology, broadly defined as software or hardware that has some form of national defence purpose, has rocketed.

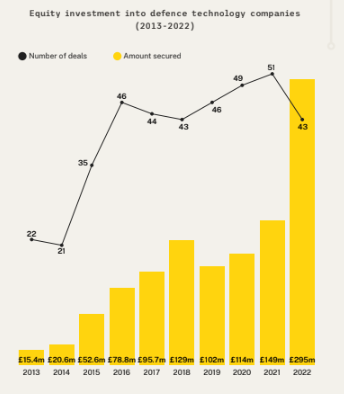

New data from research firm Beauhurst and venture investor MD One shows that investment into defence tech firms in the UK nearly doubled from £149m in 2021 to £295m last year – up from just £15.4m in 2013.

Among the most rapidly expanding defence tech companies are Oxfordshire firm Luffy AI, which uses artificial intelligence to develop “autonomous software for robotics”; automated drone firms Flare Bright and HeroTech8, and Bedford-based sustainable aviation firm Greenjets (pictured above).

Henry Whorwood, head of research at Beauhurst, tells City A.M. the reasons for the uptick are two-fold: national defence budgets are rising and analysts have reshaped the boundaries of ethical investments.

“Part of this is related to how these things were seen as too hot to handle for a while, and completely outside the scope of ESG. And then the war in Ukraine happened and everyone’s recalibrated a bit,” he tells City A.M. “National security and defence are not necessarily now classified as ESG, but they have become a lot [more] palatable.”

Analysts at Citi said just after the invasion last year that defence was “likely to be increasingly seen as a necessity that facilitates ESG as an enterprise as well as maintaining peace stability and other social goods.”

Investors now champion what may have previously been seen as the technology of war as the tools of peace.

“It is increasingly recognised that a strong defence industry backed by technological innovation is necessary to defend against the spread of authoritarian governments and advance a rules-based international order,” said Jamie Gray, a senior manager at private equity firm CIT.

Bumper defence budgets

Rising national defence budgets also make the industry a far larger commercial opportunity for venture firms than previous years.

As war in Ukraine hit, consumers and businesses felt the squeeze of rising prices and tightened their spending power. The Ministry of Defence, however, like its international counterparts, has been given a meatier budget to spend.

“That’s the thing that underpins the broader national security innovation cohort – it has the government as a customer, which even even in a recession will continue to spend quite well,” Whorwood says.

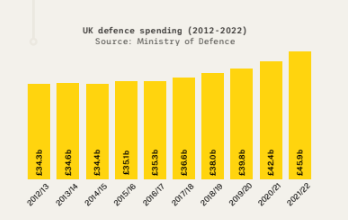

And that budget will continue to climb. The Ministry of Defence’s spending has increased from £34.3bn in 2012 to £45.9bn last year, and more cash will be set aside as Ukraine and national defence dominates the national discourse.

Emile Simpson, a renowned military analyst and now investment adviser, says the shocks of the past year will mean governmental spending power is likely to grow.

“Geopolitically, competition to develop the next generation of defence tech, including the computing that underpins it, is driving policy across several other areas, from digital sovereignty to semiconductor supply chains, not only in the UK and Europe but globally,” he says.

“This trend plays out in structural changes in global defence spending today, both in terms of an increase in scale, but crucially too, in terms of a renewed focus on technological innovation, of an intensity not seen since the early Cold War.”

The surge in venture investment into defence tech notched over the past year may not, therefore, be just a short-lived boom.