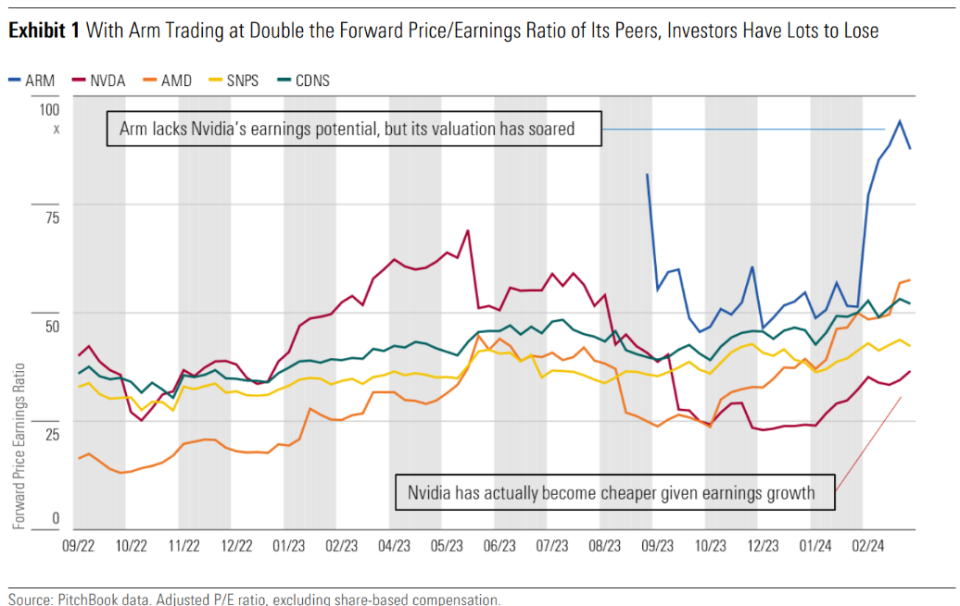

Arm is overvalued, will struggle to keep up with Nvidia says new report

According to a sobering analysis by investment research firm Morningstar, British chip designer Arm is overvalued and will struggle to keep up with its competitor, Nvidia.

Despite a bumper market performance, with its New York-listed stock soaring nearly 100 per cent in the past year to highs of $149, Morningstar said Arm is overvalued due to a lack of substantial research and development (R&D) investment.

It is also unlikely to match the long-term earnings potential of its meatier rival Nvidia. Shares in the latter have rallied nearly 220 per cent over the past year.

Morningstar equity analyst Javier Correonero said that while Arm is benefiting from the artificial intelligence (AI) boom, this is not central to its core operation.

“Investing in Arm shares appears to offer limited upside and considerable downside,” he warned. Morningstar’s analysis argued that Arm must prioritise continued investment into research and development (R&D) if it wants to sustain its growth.

Arm, which has benefited from soaring demand for AI across global economy, reported sales north of $800m in its most recent quarter, smashing analysts’ estimates.

But Morningstar’s fair value estimate for Arm is only $57, a stark contrast to its $140 share price reached in March and today’s price of around $125 per share.

The research firm said that to justify its current share price, Arm would need to “drastically hike” its royalty rates by fivefold over eight years, risking customer loss to competitors like RISC-V and jeopardising its position in the market.

“With this in mind, we believe investors have much to lose and little to gain by buying Arm shares,” Correonero said.

Arm’s business model revolves around designing semiconductor intellectual property (IP) such as processors, graphics processing units (GPUs), and other components used in many electronic devices such as mobile phones.

Instead of manufacturing these chips, it licenses the designs to other companies, typically semiconductor manufacturers like Qualcomm, Samsung, and Apple. These companies then incorporate Arm’s designs into their chips, paying Arm royalties for the right to use its IP.

The report also pointed out that Arm’s lack of control over customer volumes and prices makes achieving significant profit growth challenging.

In short, Arm is stuck in something of a ‘catch 22’ situation, where it must choose between innovation and turning profit.

On the one hand, if it wants to keep growing its market share and revenue by raising royalty rates, this will require higher R&D spending to create better and more efficient designs for its chips.

But this much spending would eat into Arm’s profits and lie at odds with the 55 per cent long-term operating margin needed to justify its current share price.

Morningstar said the stock’s forward price-to-earnings (p/e) ratio of 88 times is nearly double that of its peers at 47 times. To address this, it suggested Arm should invest $15bn in R&D over the next seven years, the equivalent of 33 per cent of revenue on average.